Conferences in Europe

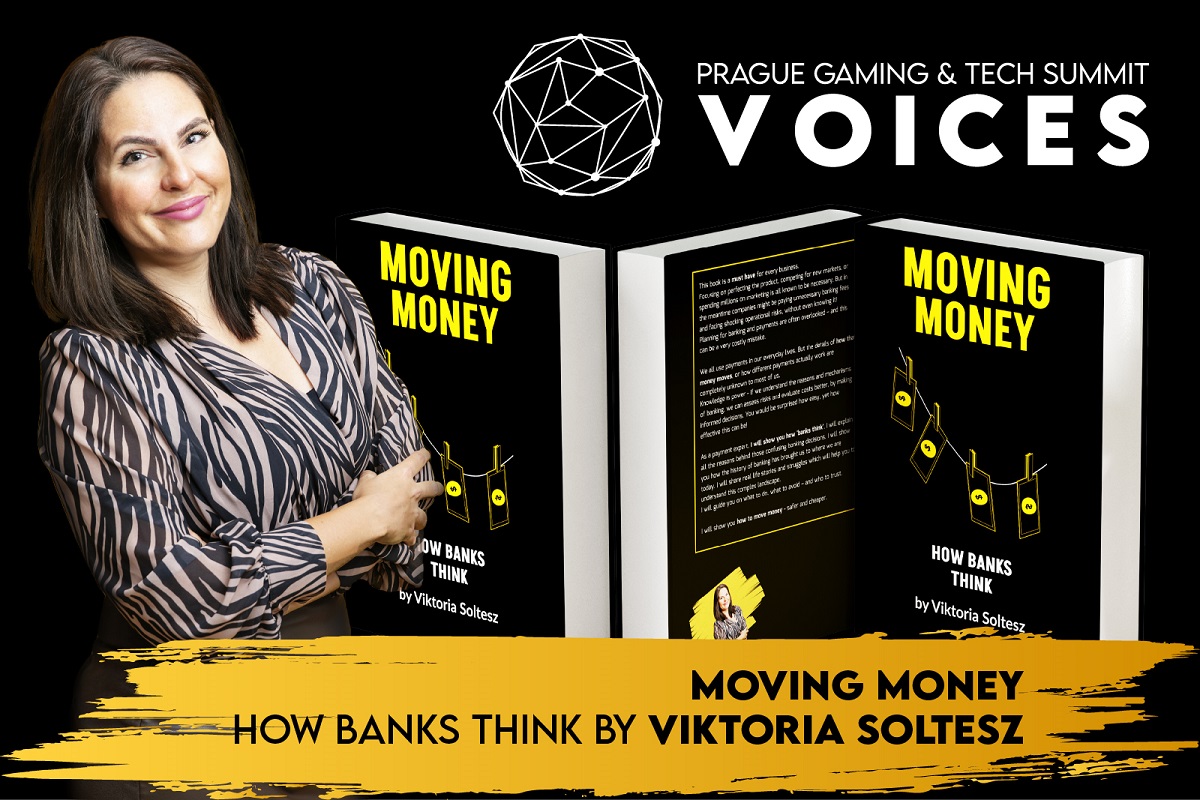

Viktoria Soltesz: the Online Payments Pro Teaching Us How Money Moves

Viktoria Soltesz is a Payment Consultant, BusinessWoman of the Year 2023, and now an Author, with her book “Moving Money – How Banks Think”, being published on all Amazon stores since early January 2024.

Viktoria is the founder and CEO of PSP Angels Group – an independent payment consulting firm with a vast understanding of the payment market, and an extended network of banks and financial providers, offering personalized payment consulting services, helping clients operate their business globally.

In her book, “Moving Money – How Banks Think”, she walks the reader through the history of transactions and financial systems, offers a detailed explanation of basic banking principles, and delves deep into payment solutions, requirements, risk policies, and compliance limitations associated with online payments.

Viktoria, congratulations on the publication of your book, and thank you for joining us to share more information about it with our readers! In the Foreword of the book, you introduce yourself, detailing your professional background and your fascinating journey into the world of online payments. Can you please give us a short introduction here as well?

My adventure began in England, where I worked for a well-known accounting software company, witnessing firsthand the globalization of financial practices. My move to Cyprus coincided with the adoption of the Euro, offering me unique insights into the island’s financial dynamics. In Cyprus, I started working in accounting and finance, offering tax planning and managing complex global transactions. When I faced various payment and banking compliance challenges, I determined to understand the payment industry and founded PSP Angels, an independent payment consultancy. My goal with the book is to simplify the payment and banking industry, educate businesses about the importance of compliance, and foster understanding between clients and payment service providers.

Blending personal anecdotes, real time stories and my professional experiences, I describe the challenges businesses face in navigating the evolving landscape of online payments. The book aspires to contribute to making online payments more efficient, secure, and understandable, while encouraging open discussions within the industry.

In the book, you speak of “Financial Literacy” and “Payments Literacy”, and how this fundamental knowledge is not taught in schools. Can you give us a brief summary of the key points that businesses should be aware of and take into consideration when setting up their financial operations? What are the basics of “Financial Literacy” and “Payments Literacy”?

Finance is the language of business and understanding the basics of accounting, taxes, and financial expressions is a must for every business. Financial Literacy is the knowledge to manage money effectively, and plan for future financial goals. Knowing the financial terms and concepts helps businesses to make informed decisions regarding savings, investments, and debt. On the other hand, Payments Literacy is often neglected and misunderstood. The concept of “how money moves” globally is not taught in schools, however today all businesses need to understand how to navigate various payment methods, systems, and processes. Payments Literacy encompasses a range of topics related to financial transactions, including online payments, electronic transfers, and traditional banking methods. It is essential for businesses to understand cybersecurity, the various compliance and regulatory environments, plan banking and payments ahead and source and select the relevant providers for these transactions. All international companies need to be aware of diverse payment methods to align with local customer preferences. Payments Literacy is complementing Financial Literacy and they are both vital for effective business operations.

As you describe your journey into payments and how the problems you encountered lead to understanding, you share instances of complicated structures, early financial compliance attempts and rigid bank processes around the mid ‘00s to 2010s. How has the landscape evolved by now? Would you say that compliance has found its footing, have the banking and payments processes become more clear and friendly to businesses and consumers alike?

I believe that challenges in payment and banking have become more complex and will continue to evolve. With the increasing shift of businesses to online platforms and their expansion into international markets, complexities in payment and banking processes are on the rise for everyone involved. Maintaining transparency, ensuring compliance, and managing the risks associated with uncertain territories and service providers has become a challenging task. The emergence of new technologies, such as crypto payments, and the variety of currency and asset management options add an extra layer of complexity to these challenges. Not to mention the various cybersecurity and data protection requirements, too. Businesses today not only need to be experts in the traditional financial structures but also have to adapt to the dynamic landscape of digital payments, banking, and payment methods. Successfully addressing these multifaceted challenges requires heightened awareness, strategic planning, and a commitment to staying informed about evolving technologies and about the ever-changing regulatory landscapes.

How has Fintech played a pivotal role in shaping the evolution of the payment market, and what key contributions or innovations has it introduced over the course of its history?

Fintech became a powerful force reshaping the traditional banking and payment market. Innovations in such a conventional industry was much needed and have significantly improve the efficiency and accessibility of financial transactions. One noteworthy contribution is the introduction of mobile payments, enabling individuals and businesses to seamlessly conduct transactions through their smartphones. This shift to mobile-centric solutions not only simplifies the payment process but also promotes financial inclusivity, reaching individuals who may not have had access to traditional banking services. This has opened up new markets for global trade.

Fintech also brought us the digital wallets and peer-to-peer payment platforms, facilitating fast and secure fund transfers. These innovations have transformed consumer expectations, placing emphasis on speed, convenience, and heightened security in financial transactions. Fintech has driven progress in data analytics, enabling more sophisticated risk assessment and fraud prevention measures. The integration of Application Programming Interfaces (APIs) has played a pivotal role in fostering collaboration between financial institutions and Fintech entities. This interconnected ecosystem has resulted in the creation of diverse financial solutions, ranging from automated budgeting tools to advanced investment platforms.

Speaking of Fintech, in practical terms, how are Blockchain and Cryptocurrencies currently being utilized in everyday applications within the payments system, and what impact are they having on traditional payment methods?

Blockchain and cryptocurrencies, although holding significant promise, currently face challenges in practical application within everyday payment systems. Unfortunately, these technologies have become vulnerable to misuse and scams due to the absence of regulation, undermining their positive potential. Despite their increasing adoption, the tarnished reputation blocks widespread acceptance. In every country, authorities worry that unmonitored transactions may facilitate tax evasion or criminal activities. Although efforts are underway to implement regulations and bring order to the landscape, the current situation remains complex, still providing opportunities for creative individuals to exploit gray areas. The potential benefits of blockchain and cryptocurrencies, such as enhanced security and transparency, are unfortunately still overshadowed by instances of misuse. Achieving widespread adoption necessitates not only technological advancements but also a coordinated effort to address regulatory ambiguities. It is crucial to educate users about the legitimate and responsible use of these innovations. Until a balanced and well-regulated approach is established, the transformative potential of blockchain and cryptocurrencies may be hindered by their association with illicit activities. This underscores the critical need for a comprehensive and carefully regulated integration into mainstream payment systems.

Readers will have the opportunity to meet you and get their book copies signed at the Prague Gaming & TECH Summit, on 26-27 March 2024; you will be participating as an expert speaker in two panels: “Navigating the Future: Integrating iGaming, AI, Fintech, and Advertising with Compliance and Data Privacy”, and “Capital Navigation: Expert Strategies for Securing Investment”. Can you give us a sneak-peek of the key points you will be discussing?

In the upcoming discussion, I’ll be sharing practical tips to help the audience navigate common challenges with banking and payment pproviders and their products, digital assets, and other payment methods, mainly present for the iGaming sector. My focus is on providing valuable insights into more cost-effective and secure banking and payment providers. Unfortunately, the iGaming sector is still facing serious payment and banking challenges, and complexities of global fund transfers. I’ll offer advice on executing these transactions in a safer and more economical manner. The aim is to deliver substantial content value to the audience by offering real-life tips and conducting workshops that empower individuals to navigate the intricacies of financial transactions with confidence.

In ‘Moving Money – How Banks Think, you mention that your goal is to introduce a new approach in both payment planning and execution. What are the key insights that businesspeople and everyday individuals can gain from your book, and in what areas can they seek your professional consultation?

In the book, I’ve distilled years of experience into a practical method outlined in the Strategy section, serving as a step-by-step guide to minimize risk and optimize costs for any online business. My consultancy work aims to bridge knowledge gaps by providing a detailed explanation of basic banking principles and fundamental economic concepts. I assist businesses by offering insights on staying updated about emerging payment and banking trends. My work helps clarifying various aspects and benefits of online payment solutions, positioning for innovation, seizing growth opportunities, exploring global payment methods and their impact on customer satisfaction, acquisition, and retention. I also provide guidance on understanding various regulations and compliance for navigating legal landscapes, ensuring data security and protecting consumer rights. My 20+ years payment and financial experience helps businesses creating effective payment plans for their complex online payment and banking flows. This comprehensive approach is designed to empower businesses with the necessary knowledge and strategic insights to successfully navigate the intricate world of payments.

Thank you for your time and this riveting interview, Viktoria! We look forward to seeing you at the Prague Gaming & TECH Summit this March, learn more about the exciting updates in the ever-evolving world of payments, and get our books signed!

Conferences in Europe

CasinoBeats Summit 2024: Providing the Tools to Balance Innovation and Regulation in the Digital Age

As the industry seeks optimal methods to responsibly integrate innovative technology, the upcoming CasinoBeats Summit will provide delegates with an exploration of the latest emerging technologies, regulatory frameworks and future trends to ensure a safe yet immersive gaming experience for players.

The Industry and Leadership track will take place across both core days of the CasinoBeats Summit, May 22 to 23 at the InterContinental Malta. Panel sessions will delve into key topics such as global gaming regulations, the evolving digital payment landscape and an in-depth exploration of the world of M&A.

The panel entitled Responsible Gambling in the Digital Age will delve into the latest responsible gambling initiatives influencing the digital landscape. Expert speakers Pedro Romero (RG Consultant and psychologist, University of Gibraltar), Matthew Curtis (Head of Responsible Gaming, L&L), Georgia Wise (Head of Responsible Gaming, PlayNorth), Eduards Jakubovs (Head of Responsible Gaming, Betsson) and panel moderator Maris Catania (Senior SG Consultant, SG: Certified) will analyse the impact of landmark regulatory guidelines such as the 3.4.3 regulation on remote customer interaction and the United Kingdom’s ‘white paper’ as well as discuss the latest distinctions between regulated, grey and black markets.

The Industry Trends and Future Predictions panel will look at the future of the casino sector, examining upcoming industry trends and their potential impact. Industry leaders Itai Zak (Executive Director, Digicode, and former/ex-Chief Executive Officer, SBTech), Matthew D’Emanuele (Chief Executive Officer, Yolo Entertainment), Alexander Martin (Chief Executive Officer, SKS365), Inesa Glazaite (Chief Commercial Officer, iGaming Platform), Dmitry Starostenkov (Chief Executive Officer, EvenBet) alongside panel moderator Martyn Elliott (Project Director, SBC Media) will offer insights into key emerging markets, innovative game formats and strategies to effectively cater to evolving player needs.

Commencing the second day is the panel entitled The Evolving Landscape of Gaming Sector Payments, which will explore the current state of the industry’s payment sector. Expert speakers Sean Spiteri (Head of Payment Solutions, PressEnter), Enrico Giancaterina (Managing Director, Funtech) and Ian Perrygrove (Chief Risk Officer, Kwiff) will discuss the current payment innovations driven by the casino sector, analyse the future of digital payment methods and the potential risks of such rapid innovations.

The Navigating the Future: Global Gaming Regulations panel will explore strategies to effectively address the challenges posed by current and future global regulations. Regulator representatives Aideen Shortt, (Advisor to the Minister, Curacao), Andrew Lyman (Gambling Commissioner and Executive Director, Gibraltar), Andrew Rhodes (Chief Executive, Gambling Commission) and Brandon Debattista (Deputy Chief Regulatory Officer, Malta Gaming Authority) will provide insights into their respective markets whilst assessing the possibility of a unified global regulatory standard and the importance of cross-market collaboration.

Additionally, track attendees will have the opportunity to garner insights into the world of acquisition and investment during an exclusive IMGL-led masterclass, Acquisition Strategy: Gearing up for Investment, which is set to take place on Thursday, May 23, the second core day of the event.

For groups of three or more, you can purchase the Group Pass Ticket and gain access to all three days of the CasinoBeats Summit for the discounted price of €400 per person (a saving of €200 per ticket). Additionally, operators and affiliates can apply for a free pass to the event.

You can keep up-to-date with the latest news, speakers and exhibitor additions and conference content by subscribing to the bi-weekly CasinoBeats Summit LinkedIn newsletter.

The post CasinoBeats Summit 2024: Providing the Tools to Balance Innovation and Regulation in the Digital Age appeared first on European Gaming Industry News.

Conferences in Europe

Success for the First Edition of the Italian Gaming Expo & Conference

The two-day conference dedicated to the Italian gaming market registers over 1,200 participants and gathers international acclaim: new appointment in April of 2025

The first edition of the Italian Gaming Expo & Conference (IGE) in Rome entitled ‘The sustainable future of gaming’ dedicated to the Italian gaming market is delving into the reality of a sector whose importance is recognized internationally together with institutions, experts, academics, opinion leaders and influencers. With the participation of around 1,200 delegates from over twelve different countries and the presence of multiple political, institutional and media personalities.

IGE Figures:

Over 130 speakers coming from several countries in Europe and the world. More than 35 sessions of content. Over 50 companies involved including partners and exhibitors. Over 20 political representatives and more than ten institutions represented including Agenzia delle Dogane e dei Monopoli (the Italian gaming regulator), CONI, AGCOM, the Ministry of Home Affairs, the Ministry of Agriculture, Food Sovereignty and Forests (MASAF), the State Police, Italian finance police, Europol and Interpol as well as the Government and Parliament with a large presence of representatives from the Chamber and Senate. To which we must add foreign regulators such as the United Kingdom’s Gambling Commission, the Malta Gaming Authority (MGA) and various international entities such as EASG, G4, the International Masters of Gaming Law (IMGL), the International Association of Gaming Regulators (IAGR) and the United Lotteries for Integrity in Sports (ULIS). These are the numbers of the first edition of IGE. With a presence that reached 1,187 delegates in the two days of the event.

At the heart of the event, the main topics that will drive the world of legal gaming in the coming months and years and the definition of the approach guidelines for companies that want to look to the future to innovation to sustainability. The reform of public gaming, the sustainable future of gaming, the strength of promotions between reorganization and consumer protection and the Italian model as a reference to ensure the integrity of sport in addition to the reform of horse racing. These are some of the topics discussed during the first day.

One of the primary goals of IGE is to allow participants to meet and discuss with experts, opinion leaders, scholars and some of the best C-levels at national and international level to find new ideas and solutions for the growth and development of their business. And it can certainly be considered achieved, taking into account the broad consensus recorded by the event, which also recorded the presence of authoritative exponents of the world of information, from the television presenter and deputy director of Il Giornale, Nicola Porro, to the deputy director of the La7 news program and host, Andrea Pancani, to the Director of RaiNews24, Paolo Petrecca.

“The Agenzia delle Dogane e dei Monopoli, as a regulatory body for the public gaming sector, has always been at the forefront in the defence and promotion of the principles representing the cornerstones on which the gaming industry is based,” the Central Games Director for the Agenzia delle Dogane e dei Monopoli, Mario Lollobrigida, said. “Those of legality, safety and protection of consumers and public order. For this reason, the agency welcomed this Italian gaming expo and conference event as it is exactly focused on these communication values. In particular, we appreciate the highly scientific profile of the event, thanks to the participation of famous personalities and leading universities such as those of the Luiss, Bocconi and Politecnico di Milano, who will participate in these two days of debate.”

As regards the pressing current issues that animated the IGE discussion, the reform of the sector just launched by the government was undoubtedly at the center. “The new law is a chance for the state to undoubtedly find some additional resources from the tax levy, resources that allow the administration to make its choices,” Marco Osnato, President of the Finance Commission, Chamber of Deputies, said. “With this decree we have managed to achieve a balance of interests that is healthy for everyone. We always start from the protection of the citizen, the use of effective, traceable and exact legal services also in compliance with legal systems that have become more limited with a view to protecting and professionalising companies. A more peaceful approach.”

According to Ettore Rosato, COPASIR Secretary, member of the Foreign Affairs Commission, Chamber of Deputies: “Gaming is a sector that I have been dealing with for a long time and I believe it is essential that politics recognize its value both in economic terms from tax revenue to the number of employees and companies on the market to the terms of legality and social impact. Public gaming is an obstruction to organized crime and is a controlled system, which also allows us to control the risks of gambling addiction that may arise.”

However, pay attention to all the topics of interest and current affairs that revolve around the sector, starting with the ban on advertising, which is still in force today. Laura Aria, AGCOM Commissioner, declared: “According to article 57 of the Treaty on the Functioning of the European Union, the provision of gaming service cannot be completely banned. Moreover, managing highly addictive phenomena such as gambling addiction with a prohibitionist approach towards the medium, ie gambling, does not seem to be an effective solution. I believe that a better awareness campaign and inter-institutional cooperation is needed. Legislation and monitoring of gambling allow for better management of gambling addiction. Therefore, investing in prevention is the central point.”

But there was also talk of match-fixing and the Italian intelligence network based on the betting sector that represents excellence on a global level. According to Ugo Taucer, Attorney General, CONI: “Even before the Macolin convention, there is an Italian tradition of discussion between police forces, institutional bodies responsible for games control, private operators, federations and sports through the Luiss office, which establishes institutional cooperation and an exchange of news. There is a wide scope for exchange and discussion, a strong correspondence between the various areas.”

There is a lot of content relating to responsible gaming with particular attention to the investigative works presented in preview by the FAIR Foundation, as its President, Matteo Caroli, explains: “In Italy, there are no independent foundations dedicated to responsible gaming. With the Fondazione FAIR, we want to promote a gaming culture that focuses on prevention as well as respect and people protection through the development of lines of scientific research, studies and research. We also aim to promote cooperation and study activities with qualified third parties, thus adopting a multidisciplinary approach open to discussion with everyone.”

According to Alessio Crisantemi, co-founder and Gn Media President, Organizer of IGE: “The gaming industry is a real source of talent and cradle of true excellence, especially in Italy. In this sense, we are proud of the success of this event, which offers a precious opportunity for discussion and training between stakeholders, institutions and operators on crucial issues for the future of the sector such as sustainability and innovation. But innovation is not for its own sake, neither only oriented to profitability or product appeal, but applied above all in the search for solutions and systems for consumer protection and safety. Therefore, these two days of meetings and discussions are even more important in order to give proper prominence to a sector that needs to be promoted and enhanced as it can substantially contribute to the growth of the country but in a sustainable way.”

The event, which aims to be an annual event for the industry, closed by announcing the next dates of April 9 to 10, 2025.

The debut of the Italian Gaming Awards:

The first edition of IGE was crowned by the gala evening of the Italian Gaming Awards hosted by the Director of RaiNews24, Paolo Petrecca, and the actress Giorgia Fiori, who celebrated the excellence of gaming in Italy awarding 19 prizes to operators, suppliers and other categories. The complete list of winners can be consulted at this address: https:/ /ItalianGamingAwards. com/IGA2024/it/page/iga-2024-winners.

The post Success for the First Edition of the Italian Gaming Expo & Conference appeared first on European Gaming Industry News.

Conferences in Europe

ITL Spain head to Madrid for the largest gaming exhibition in the Spanish calendar

Innovative Technology (ITL) have announced their participation at the largest global network of gaming professionals in Spain. From 7-9 May 2024, Madrid will become the centre of the Spanish gaming industry, celebrating the 40th anniversary of Feria Internacional del Juego (FIJMA).

FIJMA is the most important event in the leisure and gaming industry in Spain where the main companies, manufacturers and experts in the industry gather to learn about the latest slots and gaming equipment innovations. The Spanish team at ITL will be exhibiting their solutions on stand A49 and plan to have their latest note recyclers and coin handling products centre stage, as well as demonstrating how their biometrics solutions can be utilised to benefit the gaming industry to prevent underage gambling.

Jose Garcia Escudero, General Manager for ITL Spain said, “We are looking forward to showing how combining our compact note recycler (NV22 Spectral) and advanced coin recycler (SMART Coin System) gives the best fit for cash handling efficiency for gaming machines in Spain. These solutions now dominate the Spanish gaming market giving operators considerable float management savings, fewer refills, and a massive reduction in coin starvation for improved machine uptime. We’ll also show the new NV4000 mixed denomination note recycler to the Spanish gaming market for the first time, ideal for high volume applications like change and redemption terminals.”

ITL have a range of AI-powered biometric solutions which perform accurate age verification at gaming venue entrances or integrated in gaming machines.

Continuing Jose said, “We will also have our age check devices on the stand for visitors to demo which can help operators prevent someone potentially underage or even self-excluded trying to play a machine or access an age restricted area. ICU Lite can be fully integrated in a gaming machine or betting terminal to automatically estimate age to prevent minors from playing. MyCheckr can be utilised at 18+ entrances to prevent access. Both devices have a one-off cost with no subscriptions and no internet required. Our technology is affordable, available to all and trusted, with no biometric personal data stored.”

Concluding Jose said, “We have very strong relationships with the Spanish market and we’re proud to know that our products will be displayed on a number of stands from our long standing customers. We’re looking forward to seeing everyone in person in Madrid and we welcome you all to stand A49.”

The post ITL Spain head to Madrid for the largest gaming exhibition in the Spanish calendar appeared first on European Gaming Industry News.

-

Africa3 weeks ago

BMM Testlabs Continues Its Expansion in Africa with New Licenses in Botswana and Nigeria to Test Land-Based and Digital Products

-

Australia3 weeks ago

VGCCC Fines Bookmaker MintBet $100,000 for Repeat Breaches of its Responsible Gambling Code of Conduct

-

Compliance Updates4 weeks ago

Compliance Updates4 weeks ago3 Oaks Gaming extends European reach with Romania licence

-

Central Europe4 weeks ago

Central Europe4 weeks agoGaming Corps makes key European addition with Fortuna Entertainment Group partnership

-

Press Releases2 weeks ago

Press Releases2 weeks agoOpenBet Powers Record-Breaking 100,000+ Peak Bets per Minute at Grand National 2024

-

Africa3 weeks ago

KingMakers’ Nigerian operating business, BetKing, selects Genius Sports to power growth with in-play trading services

-

Africa3 weeks ago

Africa3 weeks agoIESF African Regional Qualifiers Host Announced

-

EurAsia3 weeks ago

EurAsia3 weeks agoFastex Forges Partnership with Olympionic Foundation to Boost Sports Development in Armenia