Latest News

GROUPE PARTOUCHE: Income 1st half year 2020/2021 – Operating performance impacted by the health issue

During the meeting it held on the 29th of June 2021 and after having reviewed the management report of Groupe Partouche Executive Board, the Supervisory Board examined the audited accounts for the 1st half-year 2020-2021 (November to April).

Operation performance impacted by the health issue

The Covid 19 pandemic penalized the business activity during the first half of the current financial year by the interruption of the Group’s activities over the period, with the exception of the following reopening:

- Djerba casino (Tunisia): open during the 1st half-year but forced into a curfew;

- Meyrin casino (Switzerland): open between the 14th and the 26th December 2020 but on reduced hours;

- Meyrin et de Crans-Montana casinos (Switzerland): reopening on 19th April 2021, without curfew but with health constraints;

- Belgium online gaming & betting: accessible throughout the half-year;

- Switzerland new online gaming: accessible since its launching on 16th November 2020.

The Gross Gaming Revenue (GGR) over the period decreased by -80.9% compared to the previous year, reaching € 50.0 M and the turnover by -74.3% at € 47.2 M.

The Group’s EBITDA fell to -€ 42.0 M, compared to +€ 29.8 M in the first half of 2020.

The current operating income (COI) stood at -€ 73.2 M compared to +€ 0.3 M for the previous year, a degradation directly correlated with the interruption of the activity and therefore of the turnover.

Under activity divisions, the casinos’ COI reached -€ 68.2 M, compared to +€ 6.6 M in 2020 impacted by the closing of all the Group’s casinos over the period, with the exception of the Ostend casino COI with an increase of € 1.1 M thanks to the online COI.

The COI of the hotels’ division slightly decreased to -€ 2.2 M compared to -€ 1.7 M in 2020. The Aquabella hotel at Aix-en-Provence remained open over the whole period with an idling activity while the Cosmos hotel at Contrexéville remained closed.

Lastly, the deficit of COI of the “Other” division improved at -€ 2.8 M on the 1st half-year 2021, compared to -€ 4.7 M in 2020, mainly due to the significant increase of COI of Belgian sports betting (+€ 1,0 M).

Purchases & external expenses decreased by € 7.4 M (-10.9%) mainly impacted by:

- Material purchases, advertising/marketing costs, upkeep and maintenance costs down by € 11.2 M (-69.7%), € 7.9 M (-78.4%) and € 1.4 M (-33.7%) respectively directly linked to the closure of establishments and the drop in revenue from ancillary activities;

- Conversely, the change in subcontracting costs (+€ 16.6 M), mainly linked (i) to the increase in costs associated with online licenses in Belgium, i.e. +€ 19.6 M in costs correlatively to the increase in the turnover of this activity (online casino and sports betting); and (ii) savings in subcontracting (guarding, cleaning) made in view of the closure of establishments.

Within the above development, the increase of +€ 2.0 M in purchases and external expenses relating to the “online casino” in Switzerland, which started on 16th November 2020, should be noted.

Personnel expenses amounted to € 31.5 M, down € 42.0 M (-57.2%) following in particular the allowances received for partial unemployment from which the Group benefits, to which are added the employer’s contributions savings generated as well as the exemptions / subsidiaries obtained as part of the business assistance measures put in place by the Government in response to the health crisis.

The non-current operating income is a net expense of -€ 8.6 M, compared to -€ 2.7 M in 1st half-year 2020. In Belgium, an old dispute was won against the Belgian State leading to a non-current profit of € 5.8 M. Conversely, the continuation of the health crisis led the Group to carry out goodwill additional impairment tests from the half-yearly closing. Thus, goodwill impairment in the first half of 2021 totalled -€ 15.0 M.

In the end, the net income is a loss of € 88.0 M, compared to a loss of € 3.9 M as of 30th April 2020, after taking into account the following elements:

- a financial result of -€ 2.3 M (compared to -€ 0.8 M in 1st half-year 2020), which does not benefit from any exchange gain due to the closure of casinos on both sides of the Franco-Swiss border and whose financial expenses reverse slightly (-€ 0.2 M) in connection with the increase in the Group’s indebtedness while the half-yearly average interest rate continued to decline;

- a significant increase in tax (CVAE included) (-€ 4.0 M compared to -€ 0.6 M in 1st half-year 2020).

The Group’s financial structure remains healthy and solid with “cash net of levies” of € 104.1 M, shareholders’ equity of € 283.2 M and a “net debt” of € 149.7 M (set up as provided by the terms of the syndicated loan agreement, according to the former IAS 17 standard, excluding IFRS 16).

RECENT EVENTS & OUTLOOK

Ratio of leverage

Given the consequences of the health crisis on the Group’s business and the results for the half-year, the calculation of the leverage ratio at 30th April 2021 was impossible due to a negative EBIDTA. However, the Group’s financial partners have renewed their confidence in it.

Thus, the Syndicated Loan Agent, on 9th June 2021, signed a letter on behalf of the Lenders in which the later waives:

- each of the leverage ratio calculations provided for on the two closing dates of 30th April 2021 and 31st October 2021; and

- the delivery of each of the certificates corresponding to the leverage ratio calculations on the above dates.

Likewise, on 15th June 2021, the institutional investor carrying EuroPP waived the same ratio calculations and the delivery of certificates.

Reopening the casinos

All of the casinos in the Group have reopened:

- In France, since 19th May and based on a progressive schedule :

- Starting 19th May: only slot machines and electronic table games were accessible. A gauge equal to 35% of the areas receiving public (ERP) of each establishment had to be respected. Casinos opened until 9:00 p.m. under the curfew and catering was only permitted on the terrace;

- Starting 9th June: opening of table games. The gauge rose to 50% of the ERP capacity, the casinos were open until 11 p.m. and the indoor dining areas were open again, with a limit of six people per table. In addition, the health pass was required in establishments where the operator planned to accommodate more than 1,000 people;

- Starting 20th June: general lifting of the curfew ten days in advance, the other constraints being maintained;

- Starting 30th June: the players are hosted in usual conditions with respect for the health barrier gestures (wearing a mask, physical distancing, etc.).

- In Switzerland, since 19th April, no curfew but some restrictions (10 m² per person, no catering, no smoking even in smoking rooms).

- In Belgium, since 9th June, with an obligation to close at 11:30 p.m.

- In Tunisia, the Djerba casino remained opened during the whole half-year but had to close between the 9th and the 16th May.

Overall, gaming activities have picked up in a very satisfying trend.

Upcoming events:

– 3rd quarter financial information: Wednesday 15th September 2021, after Paris stock market close

– Turnover 4th quarter: Wednesday 15th December 2021, after Paris stock market close

Groupe Partouche was established in 1973 and has grown to become one of the market leaders in Europe in its business sector. Listed on the stock exchange, it operates casinos, a gaming club, hotels, restaurants, spas and golf courses. The Group operates 42 casinos and employs nearly 4,100 people. It is well known for innovating and testing the games of tomorrow, which allows it to be confident about its future, while aiming to strengthen its leading position and continue to enhance its profitability. Groupe Partouche was floated on the stock exchange in 1995, and is listed on Euronext Paris, Compartment

Annex

Consolidated Income

| In €M – At 30th April (6 months) | 2021 | 2020 | ECART | Var. |

| Turnover | 47.2 | 183.6 | (136.4) | -74.3% |

| Purchases & external expenses | (60.6) | (68.0) | 7.4 | -10.9% |

| Tax & duties | (5.6) | (8.8) | 3.1 | -35.6% |

| Employees expenses | (31.5) | (73.6) | 42.0 | -57.2% |

| Depreciation, amortisation & impairment of fixed assets | (28.5) | (29.0) | 0.5 | -1.82% |

| Other current income & operating expenses | 5.9 | (4.0) | 9.9 | -247.4% |

| Current operating income | (73.2) | 0.3 | (73.4) | n/a |

| Other non-current income & operating expenses | 6.4 | 0.0 | 6.4 | – |

| Gain (loss) on the sale of consolidated investments | – | – | – | – |

| Impairment of non-current assets | (15.0) | (2.7) | (12.3) | – |

| Non-current operating income | (8.6) | (2.7) | (5.9) | – |

| Operating income | (81.8) | (2.4) | (79.3) | n/a |

| Financial income | (2.3) | (0.8) | (1.4) | – |

| Income before tax | (84.0) | (3.3) | (80.8) | – |

| Corporate income tax | (3.6) | 1.0 | (4.6) | – |

| CVAE tax | (0.4) | (1.6) | 1.2 | – |

| Income after tax | (88.0) | (3.8) | (84.2) | – |

| Share in earnings of equity-accounted associates | (0.0) | (0.1) | 0.0 | – |

| Total net Income | (88.0) | (3.9) | (84.1) | n/a |

| o/w Group’s share | (81.6) | (5.3) | (76.3) | – |

| EBITDA (*) | (42.0) | 29.8 | (71.8) | n/a |

| Margin EBITDA / Turnover | n/a | 16,2% | n/a |

(*) taking into account the application of IFRS 16 in the half-year, which has the mechanical effect of improving EBITDA by €7.3 M.

Taxes and duties represent an expense of € 5.6 M down by –35.6%.

The change in amortization and depreciation on fixed assets, down -1.82% to € 28.5 M, reflects the slowdown in the sustained investment policy of recent years, hampered by the health crisis.

Other current operating income and expenses represent a net income of € 5.9 M compared to a net expense of € 4.0M in the first half of 2020. This is mainly due to operating grants received or receivable obtained as part of the business subsidiaries measures put in place by the Government in the face of the health crisis, in particular the fixed costs subsidiaries for € 10.0 M.

The operating income stands at -€ 81.8 M against -€ 2.4 M in the first half of 2020.

Income before tax represents a loss of € 84.0 M compared to a loss of € 3.3 M in the first half of 2020.

The tax expense (including CVAE) reached € 4.0 M, compared with € 0.6 M in the first half of 2020. The exceptional income recorded in Belgium following a dispute amounts to a tax of € 1.3 M. Conversely, CVAE’s tax charge decreased due to the shutdown of the Group’s activity over the half-year. With regard to deferred taxes, the Group has adopted the cautious position of not activating, even partially, the tax losses related to tax consolidation generated over the half-year (against a deferred tax asset of +€ 1.8 M during the 1st half-year 2020).

The quota-share of earnings of equity-accounted associate remained stable and non-material.

The consolidated net Income over the half-year is a loss of € 88.0 M against a loss of € 3.9 M at 30th April 2020, of which the Group share represents a loss of € 81.6 M compared to a loss of € 5.3 M at 30th April 2020.

Balance Sheet

Total net assets at 30th April 2021 decreased, totalling € 753.7 M against € 787.7 M at 31st October 2020. The remarkable developments during the period under review are as follows:

- A decrease in non-current assets of € 35.2 M mainly due, on the one hand, to the decrease in the “tangible fixed assets” item to the tune of -€ 17.5 M resulting from the depreciation expense for the half-year combined with the contraction in investments, and on the other hand, the decrease in the “goodwill” item for € 15.0 M, linked to the depreciation in the half-year of goodwill of certain sensitive CGUs in this crisis context;

- An increase in current assets of € 1.3 M, mainly due to an increase in the “receivables and other debtors” item of € 12.1 M (of which an increase of € 3.3 M in receivables from social organizations due to partial unemployment indemnities receivable in the context of the Covid-19 crisis, and € 9.4 M in subsidies receivable for fixed-cost assistance); as well as “Other current assets” of € 2.3 M (in particular VAT receivables). Conversely, we note a cash consumption of € 13.2 M.

On the liabilities side, shareholders’ equity including minority interests fell from € 371.9 M as of 31st October 2020 to € 283.2 M as of 30th April 2021, weighed down by the net result for the half-year. Financial debt increased by €53.7M. Consideration should be given to:

- the subscription, in mid-April 2021, of a second loan guaranteed by the State for € 59.5 M and new bank loans for + € 4.5 M;

- the quarterly maturity of the syndicated loan settled on 30th April 2021 in the amount of -€ 2.7 M, the maturity of 31st January 2021 having been postponed to 2026, as well as the repayment of other bank loans for -€ 1.9 M;

- the postponement of the 12-month maturities (in capital and, for the most part, in interest) of the Group’s bank debts, the resumption of repayments having taken place for some in March but for the majority in April 2021.

In addition, it should be noted that, due to the negative EBIDTA induced by the closure of the Group’s establishments over the half-year, the institutional investor carrying the EuroPP as well as all the banks making up the banking pool of the syndicated loan have given up the calculation of the leverage ratio provided for on the closing date of 30th April 2021. This with a retroactive effect from 30th April 30, 2021. However, the waiver having taken place after the closing, the application of IAS 1 has forced the Group to restate all of the outstanding amounts relating to the bond loan and the syndicated loan as a current share this half-year.

Financial structure – Summary of net debt

One can consider the Group’s financial structure using the following table (set up as provided by the terms of the syndicated loan contract, according to the old IAS 17 standard, excluding IFRS 16):

| In €M | 30/04/2021 | 31/10/2020 | 30/04/2020 |

| Equity | 283.2 | 371.9 | 384.1 |

| Gross debt (*) | 253.7 | 194.7 | 168.8 |

| Cash less gaming levies | 104.1 | 103.1 | 78.9 |

| Net debt | 149.7 | 91.5 | 89.9 |

| Ratio Net debt / Equity (« gearing ») | 0.5x | 0.2x | 0.2x |

| Ratio Net debt / Consolidated EBITDA (« leverage ») (**) | N/A (***) | 2.3x | 1.7x |

(*)The gross deb includes bank borrowings, bond loans and restated leases (with the exception of old leases restated according to the new IFRS 16 standard), accrued interest, miscellaneous loans and financial debts, bank loans and financial instruments.

(**) The EBITDA used to determine the “leverage” is calculated over a rolling 12-month period, according to the old IAS 17 standard (that is to say before application of IFRS 16), at namely € 39.8 M at 31/10/2020, and € 54.3 M at 30/04/2020.

(***)The bond and banking partners have waived the calculation of the “leverage ratio” expected at the closing date of 30th April 2021 due to negative EBITDA over the period.

Glossary

The “Gross Gaming Revenue” corresponds to the sum of the various operated games, after deduction of the payment of the winnings to the players. This amount is debited of the “levies” (i.e. tax to the State, the city halls, CSG, CRDS).

The «Gross Gaming Revenue» after deduction of the levies, becomes the “Net Gaming Revenue “, a component of the turnover.

“Current Operating Income” COI includes all the expenses and income directly related to the Group’s activities to the extent that these elements are recurrent, usual in the operating cycle or that they result from specific events or decisions pertaining to the Group’s activities.

Consolidated EBITDA is made up of the balance of income and expenses of the current operating income, excluding depreciation (allocations and reversals) and provisions (allocations and reversals) linked the Group’ business activity included in the current operating income but excluded from Ebitda due to their non-recurring nature.

Latest News

7777 gaming signs a strategic iLottery content deal with Scientific Games

7777 gaming, a leading provider of digital gaming solutions, has announced a significant strategic partnership with Scientific Games a global leader in retail and digital lottery games, technology, analytics and services, to deliver digital lottery games through the SG Content Hub Partner Program.

The SG Content Hub Partner Program is a unique platform and game content partnership program featuring an expanding, highly curated selection of iLottery games from best-in-class, game studios worldwide in a variety of play styles appealing to all player types in multiple languages, as well as access to select licensed properties from the largest licensed brands portfolio in the lottery industry. Scientific Games currently serves 150 lotteries in 50 countries.

Elena Shaterova, Chief Commercial Officer at 7777 gaming, expressed enthusiasm about the partnership: “Partnering with Scientific Games represents a significant milestone for 7777 gaming, solidifying our position as a global leader in digital lottery solutions. Through this collaboration, we are poised to deliver unparalleled gaming experiences to players worldwide, driving innovation and growth in the lottery industry.”

Steve Hickson, VP of Digital Games at Scientific Games commented: “We are delighted to welcome yet another top-class lottery game studio to the SG Content Hub Partner Program. The addition of 7777 gaming and their fantastic games aligns perfectly with our goal to make a variety of digital lottery content available to existing and new Scientific Games customers. Our SG Content Hub Partner Program is developing at pace as we continue to provide our customers with frictionless access to the very best content in the industry.”

The SG Content Hub Partner Program offers a one-stop solution for accessing multiple iLottery game studios, seamlessly integrating with a lottery’s existing gaming systems and iLottery technology. It streamlines operations, simplifies tech integrations, and enhances data analytics to drive game development and iLottery portfolio management.

7777 gaming is renowned for its ability to deliver high-quality iLottery games tailored to the unique requirements of different lotteries. The company ensures that its game content meets stringent government regulations and operators’ expectations for customization. With custom-made lottery concepts, 7777 gaming guarantees enhanced player satisfaction and fosters a deeper sense of connection and loyalty to the brand.

The post 7777 gaming signs a strategic iLottery content deal with Scientific Games appeared first on European Gaming Industry News.

Latest News

Atlas-IAC’s CEO Maxim Slobodyanyuk Talks Winning Strategies & Vision for Future Growth in the iGaming Sector

Atlas-IAC, a Next-Generation iGaming platform, has been recognized as the Best Sports Betting Provider Of The Year and Rising Star In Sports Betting Technology at the Prague Gaming & Tech Awards 2024. The GamingTECH Awards annually determine industry excellence in Central and Eastern Europe. Maxim Slobodyanyuk, CEO of Atlas-IAC, tells about insights into Atlas-IAC’s innovative solutions that are reshaping the iGaming landscape and the core principles of partnership driving mutual evolution for both Atlas-IAC and its esteemed operators.

Congratulations on winning “Best Sports Betting Provider Of The Year” and “Rising Star In Sports Betting Technology” at the GamingTECH CEE Awards 2024! How does Atlas-IAC feel about receiving such prestigious recognition?

We take pride in being acknowledged as the best sports betting provider and the rising star in sports betting technology across Central and Eastern Europe. At the heart of our success lies a team of exceptional visionaries, developers, and business analytics striving to elevate the industry to new heights of technological innovation and responsible gaming practices.

I’d like to thank our great partners for choosing Atlas-IAC as their technology provider, and for subscribing to our core business principle — to evolve and grow together. Our win is our partners’ win as well.

To be the best sports betting provider entails a weighty responsibility, one we approach with unwavering dedication. These awards serve as a validation of our unwavering commitment to excellence and as a catalyst for renewed determination to shape the future of sports betting technology. We are grateful for recognition and remain resolutely committed to charting new horizons of success alongside our valued partners.

Could you provide insights into the strategies that drove Atlas-IAC’s success in the iGaming industry?

At Atlas-IAC, our success strategy revolves around building strong partnerships and establishing a notable presence in the competitive global entertainment technology market. We prioritize automation, which gives us an edge in emerging markets and allows us to onboard partners quickly and streamline operations.

Continuously improving our platform to offer a seamless Sportsbook API experience is a priority. Our aim is to deliver fast performance, smooth betting experiences, real-time risk management, advanced anti-fraud measures, and scalable solutions for partners worldwide.

Staying up-to-date, enhancing our product, analyzing market and partner needs, and proactively responding to them are essential. Being the top technological partner is a strategy that consistently works for us.

How does Atlas-IAC’s in-house developed Sportsbook differentiate itself from competitors?

Atlas-IAC’s in-house developed Sportsbook sets us apart because we have full control over its features and can make rapid improvements. Features like Personal Odds Boost and Clever Margin allow for customized experiences tailored to our partners’ needs. We focus on personalization, ensuring the product aligns perfectly with each operator’s requirements. With a skilled team dedicated to our partners’ needs, we can promptly address requests and deliver effective solutions.

Atlas-IAC offers one of the most automated Sportsbook available in the market. How does automation enhance the experience for both operators and users?

Our fully automated Sportsbook API is efficient and user-friendly, enhancing engagement and retention. It’s equipped to handle high demand periods effectively and offers tools for precise betting management and reliable results. We can swiftly develop and integrate custom modules for partners, giving us a competitive edge. We prioritize meeting partners’ needs while delivering enjoyable experiences for players, fostering mutual benefit for all involved.

What specific features or tools have been well-received by operators in the iGaming industry?

In the realm of iGaming, Atlas-IAC has garnered recognition for its remarkable adaptability and keen responsiveness to the requirements of our partners. Understanding the distinctive needs of each operator, we have crafted a tailored approach to ensure effective solutions.

One specific example of our successful tools is our Cashback feature, which serves as a versatile tool for promoting sporting events and enhancing player entertainment. This feature offers customizable settings based on specific sports, events, odds criteria, and frequency. With such flexibility, operators can effectively incentivize participation and elevate excitement levels among players.

In essence, the suite of features and tools offered by Atlas-IAC not only addresses the diverse needs of operators but also fuels engagement and growth within the iGaming industry.

What are Atlas-IAC’s goals for continued innovation and growth in the iGaming sector?

Looking ahead, our primary aim is to continually push the boundaries of innovation while delivering outstanding value to our partners. We remain steadfast in our commitment to leading the charge in the iGaming sector, fostering sustainable growth, and championing responsible gaming practices. Our strategy revolves around staying agile, adapting to emerging trends, and catering to the unique needs of operators worldwide.

The evolving sports betting landscape of 2024 underscores the critical importance of adaptability and innovation. Operators must navigate this dynamic environment marked by technological advancements and regulatory shifts, and Atlas-IAC stands ready to assist them in this endeavor.

In terms of market focus, we are meticulously evaluating opportunities in LATAM, Eastern Europe, South-East Asia, and Africa. These regions offer significant growth potential, and our tailored strategy is geared towards effectively meeting the unique demands of these diverse markets.

The post Atlas-IAC’s CEO Maxim Slobodyanyuk Talks Winning Strategies & Vision for Future Growth in the iGaming Sector appeared first on European Gaming Industry News.

Latest News

How to avoid failing at affiliate marketing in 2024?

Reading Time: 4 minutes

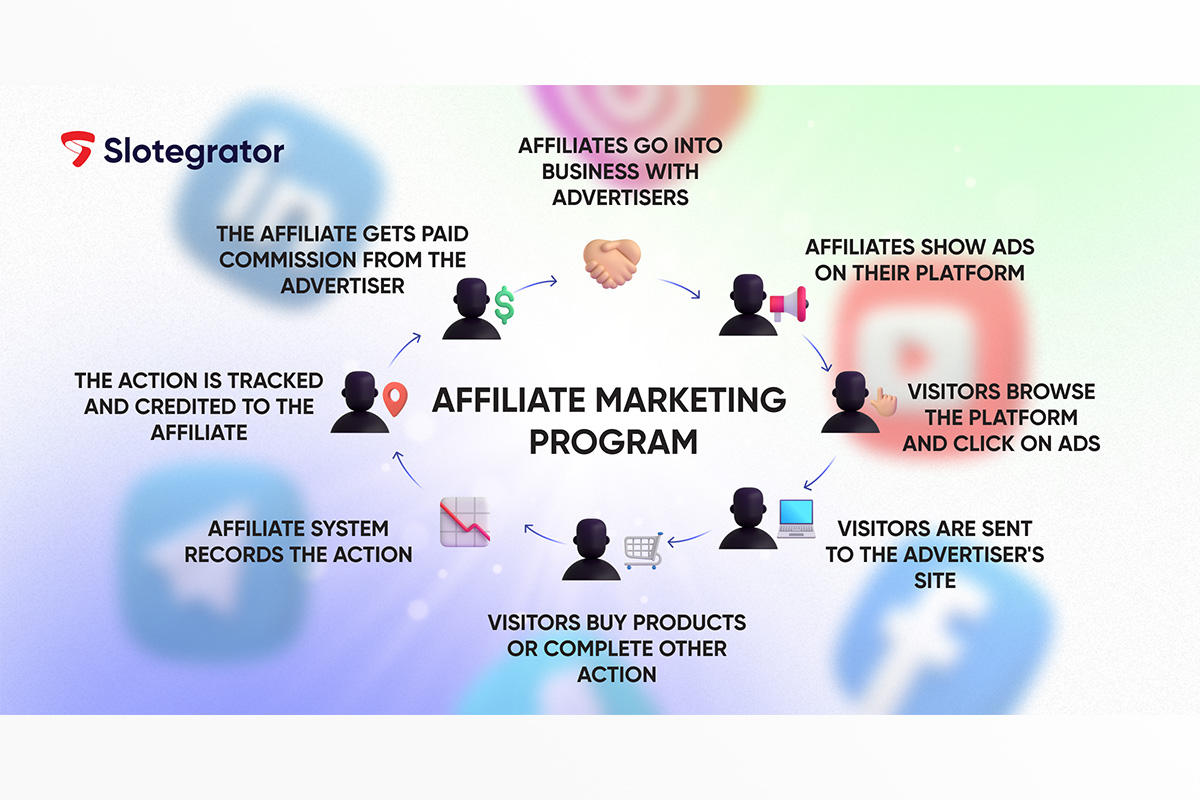

The evolving landscape of affiliate marketing within the iGaming ecosystem presents both opportunities and challenges due to regulatory shifts. Adapting to these changes is crucial to navigate the dynamic environment effectively. Slotegrator experts exploring strategies to avoid pitfalls globally and adopting adaptable approaches can optimize affiliate marketing amidst evolving regulations.

The iGaming industry has had to focus on a number of changes in the area of affiliate marketing – as a result of regulatory and advertising changes.

Beyond that, it’s important to keep in mind another important key initiatives that include key components of a successful affiliate program:

- The quality of the content the affiliate creates.

- Regulations the affiliate or affiliate program might be subject to.

- This is especially important if the affiliate expects a commission for every sign-up. If the affiliate is getting paid for every player they send your way, the players need to stay for a while for it to be worth it.

- An ongoing analysis of the size and quality of traffic the affiliate is delivering you.

To know more about these points you can read an instruction from the Slotegrator Academy by link.

The changes have not only affected the regulatory environment of the iGaming industry, but also affiliate marketing as a result of the general changes. What is important to look out for?

Slotegrator shares some regional specifics of affiliate marketing:

- Asia is a diverse and dynamic region for affiliate marketing in the iGaming industry. Affiliates operating in Asia have to navigate complex regulatory conditions and varying cultural attitudes. Marketing managers have to employ strategies that prioritize mobile channelization, collaboration with opinion leaders, and compliance with local laws — all of which are essential to success.

- Affiliate marketing in Africa is still in its early stages but is already showing significant potential. With the increasing availability of the internet and the spread of smartphones, the continent is opening up opportunities for affiliates to reach a fast-growing market. However, factors such as regulatory uncertainty, payment processing difficulties, and the cultural diversity of the region need to be taken into account.

- In Latin America working with local affiliates who have a deep understanding of the regional market helps to better customize marketing campaigns and achieve higher conversion rates. Given the strict regulation of gambling in some Latin American countries, it is important to comply with local laws and advertising restrictions to avoid negative consequences.

- Affiliate marketing in Europe is a dynamic and competitive landscape where effective strategies and a professional approach can ensure significant business success and growth in the iGaming sector. One of the important parts of affiliate marketing in Europe is the use of a variety of channels to build audiences. It helps to diversify and increase the flow of traffic to the partner’s site, which helps to increase conversion rates. Careful research of each country’s rules and restrictions is needed regarding the advertising and promotion of gambling.

Alyce Fabel from CasinoRIX, Slotegrator’s media partner, summarizes key aspects for affiliate companies to concentrate on.“As each year passes, affiliates must strive to improve and keep pace with the market. Competition is growing, regulations are evolving, and that brings changes to many regions. We can highlight five key points for affiliate companies to focus on:

- Continuously search for and acquire new traffic channels. It’s crucial not to focus only on one channel; diversification is necessary. This has been particularly evident in the past year, with significant changes and updates in SEO and mobile traffic (iOS/Android applications).

- Ensure content quality. As AI tools continue to advance, it’s essential not only to learn to apply them in work but also to differentiate content written by humans from AI-generated content (especially crucial for SEO projects).

- Configure deep analytics. Constantly work on improving traffic quality and understand where to make enhancements. The standards for traffic quality are rising.

- Provide added value. It’s time to start developing the product aspect as well, thinking not only as an affiliate but also about providing customers with additional value. This will also help in achieving higher-quality marketing.”

Cultivate relationships with partners. Build strong and lasting relationships, stay informed about all industry changes and news, and keep up with technologies and innovations. This is crucial for achieving high results.

And some words about the affiliate marketing trends as a compass to guide development efforts in this area in the right direction. Khoren Ispiryan, sales manager at Slotegrator, and the speaker of the latest Prague Gaming & TECH Summit ‘24, shares some insights:

- “The best thing is to include real people in the affiliate marketing. To create an environment where bloggers, streamers and influencers will make a bigger impact on the end user behavior.

- In 2024, gambling companies will continue to partner with influencers and other internet celebrities. These partnerships will be increasingly effective methods of attracting new audiences, promoting products, and increasing brand awareness.

- Loyalty programs and other ways of enhancing the user experience will also be essential for the promotion of gambling websites.

- The development of partner relationship management software will be a major priority. It will help improve usability for affiliate partners and enable better communication between companies and affiliates. For instance, Partnergrator from Slotegrator offers a solution for online gambling platform operators who face difficulties in tracking their affiliate program data. This innovative solution provides the ability to manage and analyze affiliate programs in real-time, using analytics to simplify the decision-making process.”

The post How to avoid failing at affiliate marketing in 2024? appeared first on European Gaming Industry News.

-

Africa3 weeks ago

BMM Testlabs Continues Its Expansion in Africa with New Licenses in Botswana and Nigeria to Test Land-Based and Digital Products

-

Australia3 weeks ago

VGCCC Fines Bookmaker MintBet $100,000 for Repeat Breaches of its Responsible Gambling Code of Conduct

-

GAT Expo4 weeks ago

GAT Expo4 weeks agoPragmatic Play Prepares for GAT Cartagena Gaming Week 2024

-

Compliance Updates3 weeks ago

Compliance Updates3 weeks ago3 Oaks Gaming extends European reach with Romania licence

-

Central Europe3 weeks ago

Central Europe3 weeks agoGaming Corps makes key European addition with Fortuna Entertainment Group partnership

-

Press Releases1 week ago

Press Releases1 week agoOpenBet Powers Record-Breaking 100,000+ Peak Bets per Minute at Grand National 2024

-

Africa3 weeks ago

Africa3 weeks agoIESF African Regional Qualifiers Host Announced

-

Africa3 weeks ago

KingMakers’ Nigerian operating business, BetKing, selects Genius Sports to power growth with in-play trading services