Central Europe

The Right RTP for the German 5.3% Turnover-taxation?

So, you may have seen a poll I have published recently with the title: “If/when Germany introduces the 5.3% turnover tax, what RTP rate is best suited considering both game-play and effective tax-paid?” If you haven’t seen it, here is the poll again for reference:

https://www.linkedin.com/feed/update/urn:li:activity:6790660730564825088/

There are a few ways of looking at this, but I think the key take-away is that the industry this poll represents is fairly evenly split between above 90% RTP and below 90% RTP.

The tax explained

First, to ensure we are on the same page, a quick explanation of the tax proposed:

Currently a 5.3% tax on turnover has been proposed and a draft-legislation does exist. I won’t go into the politics and the thinking behind this, but rather try to analyze the numbers.

A 5.3% tax on every bet being placed on an online slot means an operator can not offer an RTP over 94.7%. At 94.7% RTP, the operator would break even exactly on a bet-level, but obviously would lose money as marketing, employees and general operation have to be financed somehow. Considering financial overhead in any operation, that means the maximum RTP a casino is technically able to offer while avoiding bankruptcy is probably around 93% or more likely at 92%. This is the top ceiling and at the same time too high to be profitable.

Now, there is a bit of uncertainty and I’m also not entirely sure if the number to calculate against is 5.3% or rather 5.033%. The tax is 5.3% on turnover, meaning a 1 EUR bet causes a tax of 5.3 cents, which totals to 1.053 EUR. The tax-portion of 1.053 EUR is less than 5.3%. 100*5.3/(100+5.3) = 5.033 resp. 5.033%. I do calculations here in this document based on 5.3%.

How to balance RTP and profitability

We’ve established above that 93% or 92% is the top ceiling, but where is the bottom?

The table below shows how a Slots-operator will be taxed, calculated into the GGR-equivalent %-age number and cross-referenced with RTP. For reference, many other jurisdictions in Europe offer a GGR-based tax-rate of around 20%. As you can see from the table below, the 5.3% tax-rate on turnover wouldn’t be so bad, if players would accept 80% RTP. At 80% RTP, the GGR-equivalent tax-rate is 26.50% and thus a competitive tax-rate.

The coloring I have done here may be slightly biased, especially in terms of RTP so please take with a grain of salt. But if you roughly accept that the red-area you want to avoid on the RTP and on the GGR-% side, then you end up with an RTP-bandwidth between 84% and 91% to play with.

Further, and again granted you accept the coloring, an operator obviously wants to find an RTP in the green and a GGR-% in the green. Here we arrive at 88% and 89% RTP.

Now, a lot has been written that players will not accept such low RTP’s as say 84%. There are counter-arguments made that in land-based slots the RTP is exactly at that level and actually 88% is on the higher-end in land-based casinos.

On the other hand, for many market-participants the number “9” is a psychological blocker. Players, Affiliates and a couple of Slots-Studios I speak to feel very anxious offering product below 90% as this number still feels somewhat close to the industry-average of 94 to 97%. 89% sounds very different than 90%, although it is “just” 1% in RTP dropped.

Sportsbook vs. Casinos

It will be interesting to watch if Sportsbook or Sports-led brands will choose a differing RTP-rate than Pure-Play Casinos. A Sportsbook can more easily stay on a higher RTP and just pause all short-term expenses (bonus, marketing, etc.) and focus on cross-sell. A pure-play Casino will have to look a lot more closely on bottom-line and in my opinion will have a hard time offering e.g. 90% RTP-Slots as the GGR-equivalent tax-rate is 53%.

Game-Mechanics?

Will there be new Game-Mechanics invented to combat this problem? Looking at the table above again, the second column states how many spins a player on average can make until 1 EUR is spent depending on the RTP-Level. At 95% RTP this is 20 spins. Now, if a Game-Mechanic can be invented that provides a low mathematical RTP while at the same time provides a similar amount of real spins, then this could be a solution to the problem.

Conclusion & in my opinion

The above explanation is in no way complete – there are actually interesting studies which analyze how much an RTP is “felt” by the player and there is probably very good data the land-based industry has to offer.

But, to move away from being neutral, here’s what I personally think: The reality will be that everyone will push the RTP down and experiment with the lowest acceptable RTP as this maximizes their income. As such, come 1st of July, we’ll see a lot of RTP’s experimented with. Imagine you are a pure-play casino and you can provide a Game-Mechanic that feels good to the player and has a nice session length, while staying at or below 40% GGR-equivalent-tax. I believe things start to fall apart financially for an operator at 40% tax-rate. If you own your own media-assets and have good deals with your suppliers and run a tight operation then a 40% tax is possible to do really well in Germany. That means, the average-RTP across the portfolio will have to be around 87–88%. I think you can mix in 91% games into the portfolio just so that is part of the portfolio too, but the majority of revenue of the white-market in Germany will in my opinion come from Slots around 88% RTP. And since some games will be mixed in at 90/91% you can expected some slots to be mixed in at 84/85% rate as well.

Update 07/05/2021:

I didn’t mention in this article two other potential solutions. One is directly taxing the customer on the bet and the other is directly taxing the customer on a win (paying the tax-authorities on a bet-level, but collecting funds/tax from players on a win) like currently most sportsbetting companies do in Germany. These solutions also lower the effective-RTP-rate to the customer (just charged at a differing touch-point).

The main issue with those solutions is that an operator ends up with an equivalent-GGR taxation of around 57% which isn’t sustainable. Here are some calculations of these alternative solutions: DE 5.3% Taxation Calculations

Central Europe

Nolimit City Announces Partnership with win2day

Nolimit City, the award-winning slot provider, has announced a strategic partnership with win2day, the online gaming arm of Austrian Lotteries. Through Evolution’s in-house One Stop Shop platform, Nolimit City has officially launched its captivating game offering in Austria for the very first time.

win2day, holding the exclusive license to run electronic lotteries in Austria has long been an established player in the market, offering a comprehensive selection of games and sports betting on a single website and now hosts a selection of Nolimit City’s trailblazing titles.

Austrian gaming enthusiasts can now immerse themselves in the cutting-edge online slots crafted by Nolimit City, including the highly acclaimed Fire in the Hole xBomb. This announcement follows closely the news of Nolimit City’s recent expansion into South Africa.

Malcolm Mizzi, Commercial Director at Nolimit City, said: “After a sensational start to the year, we are thrilled to keep the momentum going with this fantastic news. Collaborating with a renowned brand like win2day underscores our dedication to expanding into new markets and only fuels our ambition to become the very best!”

Georg Wawer, Managing Director of win2day, said: “As the only licensed online gaming provider in Austria, we strive towards continuously expanding our game portfolio while also maintaining the highest quality standards. Nolimit City is the perfect fit for that. We are looking forward to a long and fruitful partnership.”

The post Nolimit City Announces Partnership with win2day appeared first on European Gaming Industry News.

Central Europe

German games market in 2023: strong development in turbulent times

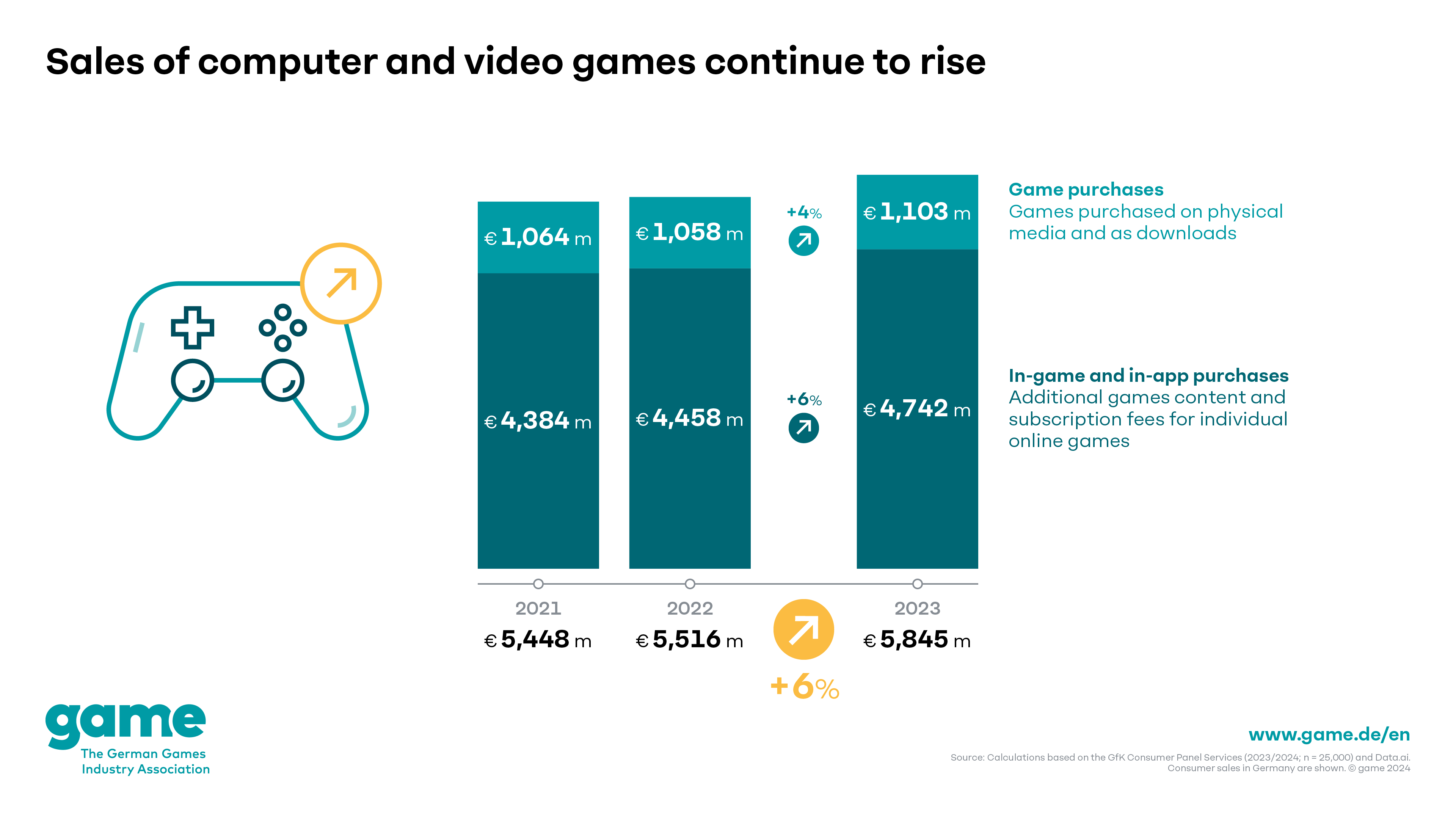

The German games market once again grew significantly overall in 2023: sales of games, games hardware and gaming online services rose by 6 per cent to around 9.97 billion euros. This is a significant increase after sales had only risen by 1 per cent in the previous year. The biggest growth drivers include games consoles and their accessories as well as in-game and in-app purchases. Despite the large number of top-class titles, which increased sales of games purchases by 4 per cent, the number of games sold fell by 8 per cent at the same time. There were also significant declines in some cases for gaming PCs and laptops. The data on the German games market is based on surveys conducted by the consumer panel services GfK and data.ai. The different developments in the individual market segments also show that 2023 was a year of contrasts for the games industry as a whole: on the one hand, more high-calibre titles were released within twelve months than ever before. On the other hand, some sales expectations were not met, particularly due to this abundance of outstanding games. Combined with generally high interest rates and a slowdown in the investment market, a wave of consolidation began worldwide, as a result of which developer studios are still being downsized or even closed and jobs are being cut.

‘The German games market continues to grow, but a close look at the data shows just how challenging these times are for game companies,’ says Felix Falk, Managing Director of game. ‘This is particularly true for small to medium-sized companies in Germany, most of which have only thin capital cover and therefore feel the impact of the tougher investment climate especially quickly. In such turbulent times reliable and internationally competitive political solutions are needed more than ever.’

Major differences between categories of games hardware

Sales revenues from various categories of games hardware developed very differently last year. Game consoles were among the most important growth drivers, posting a revenue increase of 44 per cent to break the billion-euro threshold, with total revenues of 1.1 billion euros. Demand for game console accessories was similarly robust, if at a slightly lower level. Sales revenues in this area jumped 32 per cent, to 374 million euros. In stark contrast, gaming PCs registered a clear decline as revenues from PCs and laptops marketed specially for games dropped by 17 per cent, to 547 million euros. Accessories for gaming PCs – including special input devices, graphic cards, etc. – fared only slightly better, with revenues falling by 7 per cent, to just under 1.3 billion euros.

‘Last year was the first year in a long time in which all current game consoles were easily available on the market,’ says Felix Falk. ‘The huge revenue gain in this category in 2023 shows how great the pent-up demand was among players. On the other hand, there was a clear drop in sales revenues from gaming PCs. After investing in PCs and laptops during the Covid-19 pandemic, a lot of video game players seem to be well-equipped for the moment.’

Sales revenue from games rises and gaming online services stabilise at a high level

Sales revenue from games developed positively overall in 2023. Across all platforms, purchases of PC and console games generated 4 per cent more revenue than in the year before. Total sales revenues in this area increased to around 1.1 billion euros. Considering the many high-quality game releases, however, this rise seems rather low. Indeed, the number of games sold actually dropped by 8 per cent. This reveals that the growth in revenue here is attributable exclusively to higher average prices. Last year, many video game players appear to have purchased high-quality titles shortly after their release and not waited for discounts. Also, because many of the top titles of 2023 are especially time-intensive, they didn’t leave room for players to acquire a larger number of games. In contrast, the market development for in-game and in-app purchases was significantly more positive, showing a revenue increase of about 6 per cent, to 4.7 billion euros. From an upgrade in a player character’s armour, to a season pass with a lot of additional content, to completely new campaigns, it has become ever more common for the playing time of a game to be extended or individualised through additional content. This trend continued in 2023. In-game sales revenues contribute significantly to covering continuously rising game development costs.

After a number of years of strong growth, sales revenues from online gaming services stabilised at a high level. Among the categories in this segment are fee-based subscription services that provide access to a large selection of games, cloud-based gaming, online multiplayer functions and the ability to save game progress in the cloud. Examples of these services include EA Play, Nintendo Switch Online, PlayStation Plus, Xbox Game Pass and Ubisoft+. Revenue from these services fell by 1 per cent in 2023, to 860 million euros.

The post German games market in 2023: strong development in turbulent times appeared first on European Gaming Industry News.

Central Europe

PRAGMATIC PLAY SLOTS LIVE VIA FEG IN CZECH REPUBLIC AND SLOVAKIA

The provider extends current agreement with Fortuna Entertainment Group (FEG) to supply online slots in Czech Republic and Slovakia

Pragmatic Play, a leading content supplier to the iGaming industry, has extended its agreement with Fortuna Entertainment Group (FEG) to supply premium Slots to the operator in the Czech Republic and Slovakia.

FEG’s players in its home market of the Czech Republic, along with neighbouring Slovakia, can now experience a selection of iconic Slots from Pragmatic Play, including Gates of Olympus, Big Bass Bonanza, and Sweet Bonanza.

One of the largest and most successful omni-channel betting and gaming operators in Central and Eastern Europe, FEG also provides access to online casino games in Croatia, Poland, and Romania.

The agreement marks a further strengthening of Pragmatic Play’s product offering in regulated markets throughout Europe.

Irina Cornides, Chief Operating Officer at Pragmatic Play, said: “It’s fantastic to see Pragmatic Play Slots go live with Fortuna in their own backyard, where our games have already proved popular with players. Our product offering is now available to the operator across a number of key European regulated markets.”

Myke Foster, Group Head of Gaming & Commercial Strategy at Fortuna Entertainment Group, added: “Having already taken Pragmatic Play’s games live in Romania and Croatia, we’re obviously pleased to now bring them to our entire gaming customer base across the FEG estate with the addition of Czech Republic & Slovakia. Both us and our customers know the games well, so it’s a delight to expand our relationship across Central Europe with the incredible team at Pragmatic Play.”

The post PRAGMATIC PLAY SLOTS LIVE VIA FEG IN CZECH REPUBLIC AND SLOVAKIA appeared first on European Gaming Industry News.

-

Africa4 weeks ago

Africa4 weeks agoA Comparative Analysis Of Land-Casinos and Online Casinos in South Africa 2024

-

Latin America4 weeks ago

Latin America4 weeks agoPeru Gaming Show Announces Expansion

-

GAT Expo Colombia4 weeks ago

R. Franco and R. Franco Digital to present latest products at 25th anniversary of GAT Expo Colombia

-

Australia3 weeks ago

Australia3 weeks agoCrown Approved to Retain its Melbourne Licence

-

GAT Expo3 weeks ago

GAT Expo3 weeks agoPragmatic Play Prepares for GAT Cartagena Gaming Week 2024

-

Africa1 week ago

BMM Testlabs Continues Its Expansion in Africa with New Licenses in Botswana and Nigeria to Test Land-Based and Digital Products

-

Australia3 weeks ago

Australia3 weeks agoRabbitohs and Bulldogs Pledge Three More Years to Tackle Sports Betting Advertising

-

Compliance Updates2 weeks ago

Compliance Updates2 weeks ago3 Oaks Gaming extends European reach with Romania licence