Central Europe

German Games Market Registers 6% Growth in 2019

- German games industry tops the 6-billion-euro mark

- In-game purchases and fees for online services are growth engines

- ‘The dynamic growth shows once again that games are one of the most important drivers of the digital world.’

The German games market registered continued significant growth in 2019: sales of games hardware and software rose by 6 per cent overall, to around 6.2 billion euros. These are the figures released today by game – the German Games Industry Association, based on data collected by GfK and App Annie. Sales of games hardware, including consoles, gaming PCs and accessories, dropped by 2 per cent from the previous year, to 2.4 billion euros. In contrast, the market for games software showed a gain of 11 per cent: in 2019, a total of about 3.9 billion euros was spent on computer and video games and the fees for the respective online services.

‘The German games market developed amazingly well in 2019,’ says Felix Falk, Managing Director of game. ‘Up to now, the years at the end of a console generation have been comparatively weaker economically. But we aren’t seeing any st oe now. Revenue models like in-game purchases and fees for online services have become important columns st oe games market. This means that, alongside the classic purchase of computer and video games, the long-term use of game titles is playing an ever greater role. The dynamic growth shows once again that games are one st o most important drivers st o digital world.’

In-game purchases and fees for online services are decisive growth engines

Sales through fees for online services showed the strongest percentage growth in 2019, rising by 31 per cent, to 461 million euros. These include, among other things, costs st oe online services of games consoles such as Nintendo Switch Online, PlayStation Plus and Xbox Live Gold. Also in this category are subscription services like Origin Access Premiere (EA) and Uplay+ (Ubisoft), which charge a fixed monthly rate for access to a large library of games, as well as sales for cloud gaming offerings like Google Stadia and PlayStation Now. Sales through in-game purchases also grew sharply in 2019: compared to 2018, this submarket increased by 16 per cent, to around 2.3 billion euros. In-game purchases include both small charges – to better equip one’s game character, for example – and more expensive content like whole additional campaigns and season passes. Declines were posted in other market segments, however, such as the one-time purchase of computer and video games (-3 per cent, to around 1 billion euros) and subscription to individual game titles (-10 per cent, to around 113 million euros).

About the market data

When further dedicated games hardware like gaming PCs and the corresponding accessories are taken into account, the market size for 2018 is larger than was communicated last year.

The market data is based on statistics compiled by the GfK Consumer Panel and App Annie. The methods used by GfK to collect data on Germany’s digital games market are unique in terms of both their quality and their global use. They include an ongoing survey of 25,000 consumers who are representative st o German population as a whole regarding their digital game purchasing and usage habits, as well as a retail panel. The data collection methods provide a unique insight into the German market for computer and video games.

Game – the German Games Industry Association

We are the association st o German games industry. Our members include developers, publishers and many other games industry actors such as esports companies, educational establishments and service providers. As a joint organiser of gamescom, we are responsible st oe world’s biggest event for computer and video games. We are an expert partner for media and for political and social institutions, and answer questions relating to market development, games culture and media literacy. Our mission st o make Germany the best games location.

Central Europe

Nolimit City Announces Partnership with win2day

Nolimit City, the award-winning slot provider, has announced a strategic partnership with win2day, the online gaming arm of Austrian Lotteries. Through Evolution’s in-house One Stop Shop platform, Nolimit City has officially launched its captivating game offering in Austria for the very first time.

win2day, holding the exclusive license to run electronic lotteries in Austria has long been an established player in the market, offering a comprehensive selection of games and sports betting on a single website and now hosts a selection of Nolimit City’s trailblazing titles.

Austrian gaming enthusiasts can now immerse themselves in the cutting-edge online slots crafted by Nolimit City, including the highly acclaimed Fire in the Hole xBomb. This announcement follows closely the news of Nolimit City’s recent expansion into South Africa.

Malcolm Mizzi, Commercial Director at Nolimit City, said: “After a sensational start to the year, we are thrilled to keep the momentum going with this fantastic news. Collaborating with a renowned brand like win2day underscores our dedication to expanding into new markets and only fuels our ambition to become the very best!”

Georg Wawer, Managing Director of win2day, said: “As the only licensed online gaming provider in Austria, we strive towards continuously expanding our game portfolio while also maintaining the highest quality standards. Nolimit City is the perfect fit for that. We are looking forward to a long and fruitful partnership.”

The post Nolimit City Announces Partnership with win2day appeared first on European Gaming Industry News.

Central Europe

German games market in 2023: strong development in turbulent times

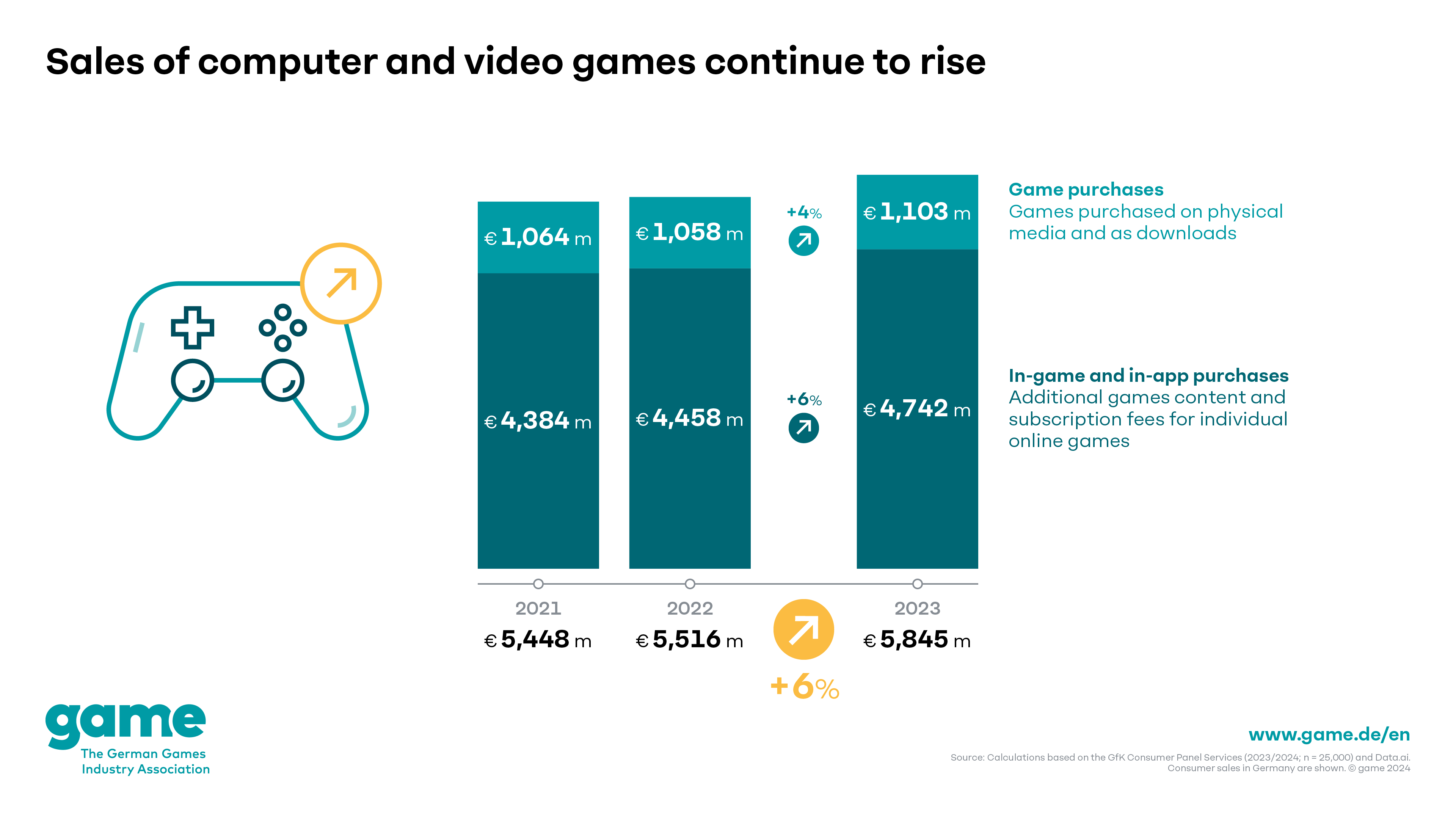

The German games market once again grew significantly overall in 2023: sales of games, games hardware and gaming online services rose by 6 per cent to around 9.97 billion euros. This is a significant increase after sales had only risen by 1 per cent in the previous year. The biggest growth drivers include games consoles and their accessories as well as in-game and in-app purchases. Despite the large number of top-class titles, which increased sales of games purchases by 4 per cent, the number of games sold fell by 8 per cent at the same time. There were also significant declines in some cases for gaming PCs and laptops. The data on the German games market is based on surveys conducted by the consumer panel services GfK and data.ai. The different developments in the individual market segments also show that 2023 was a year of contrasts for the games industry as a whole: on the one hand, more high-calibre titles were released within twelve months than ever before. On the other hand, some sales expectations were not met, particularly due to this abundance of outstanding games. Combined with generally high interest rates and a slowdown in the investment market, a wave of consolidation began worldwide, as a result of which developer studios are still being downsized or even closed and jobs are being cut.

‘The German games market continues to grow, but a close look at the data shows just how challenging these times are for game companies,’ says Felix Falk, Managing Director of game. ‘This is particularly true for small to medium-sized companies in Germany, most of which have only thin capital cover and therefore feel the impact of the tougher investment climate especially quickly. In such turbulent times reliable and internationally competitive political solutions are needed more than ever.’

Major differences between categories of games hardware

Sales revenues from various categories of games hardware developed very differently last year. Game consoles were among the most important growth drivers, posting a revenue increase of 44 per cent to break the billion-euro threshold, with total revenues of 1.1 billion euros. Demand for game console accessories was similarly robust, if at a slightly lower level. Sales revenues in this area jumped 32 per cent, to 374 million euros. In stark contrast, gaming PCs registered a clear decline as revenues from PCs and laptops marketed specially for games dropped by 17 per cent, to 547 million euros. Accessories for gaming PCs – including special input devices, graphic cards, etc. – fared only slightly better, with revenues falling by 7 per cent, to just under 1.3 billion euros.

‘Last year was the first year in a long time in which all current game consoles were easily available on the market,’ says Felix Falk. ‘The huge revenue gain in this category in 2023 shows how great the pent-up demand was among players. On the other hand, there was a clear drop in sales revenues from gaming PCs. After investing in PCs and laptops during the Covid-19 pandemic, a lot of video game players seem to be well-equipped for the moment.’

Sales revenue from games rises and gaming online services stabilise at a high level

Sales revenue from games developed positively overall in 2023. Across all platforms, purchases of PC and console games generated 4 per cent more revenue than in the year before. Total sales revenues in this area increased to around 1.1 billion euros. Considering the many high-quality game releases, however, this rise seems rather low. Indeed, the number of games sold actually dropped by 8 per cent. This reveals that the growth in revenue here is attributable exclusively to higher average prices. Last year, many video game players appear to have purchased high-quality titles shortly after their release and not waited for discounts. Also, because many of the top titles of 2023 are especially time-intensive, they didn’t leave room for players to acquire a larger number of games. In contrast, the market development for in-game and in-app purchases was significantly more positive, showing a revenue increase of about 6 per cent, to 4.7 billion euros. From an upgrade in a player character’s armour, to a season pass with a lot of additional content, to completely new campaigns, it has become ever more common for the playing time of a game to be extended or individualised through additional content. This trend continued in 2023. In-game sales revenues contribute significantly to covering continuously rising game development costs.

After a number of years of strong growth, sales revenues from online gaming services stabilised at a high level. Among the categories in this segment are fee-based subscription services that provide access to a large selection of games, cloud-based gaming, online multiplayer functions and the ability to save game progress in the cloud. Examples of these services include EA Play, Nintendo Switch Online, PlayStation Plus, Xbox Game Pass and Ubisoft+. Revenue from these services fell by 1 per cent in 2023, to 860 million euros.

The post German games market in 2023: strong development in turbulent times appeared first on European Gaming Industry News.

Central Europe

PRAGMATIC PLAY SLOTS LIVE VIA FEG IN CZECH REPUBLIC AND SLOVAKIA

The provider extends current agreement with Fortuna Entertainment Group (FEG) to supply online slots in Czech Republic and Slovakia

Pragmatic Play, a leading content supplier to the iGaming industry, has extended its agreement with Fortuna Entertainment Group (FEG) to supply premium Slots to the operator in the Czech Republic and Slovakia.

FEG’s players in its home market of the Czech Republic, along with neighbouring Slovakia, can now experience a selection of iconic Slots from Pragmatic Play, including Gates of Olympus, Big Bass Bonanza, and Sweet Bonanza.

One of the largest and most successful omni-channel betting and gaming operators in Central and Eastern Europe, FEG also provides access to online casino games in Croatia, Poland, and Romania.

The agreement marks a further strengthening of Pragmatic Play’s product offering in regulated markets throughout Europe.

Irina Cornides, Chief Operating Officer at Pragmatic Play, said: “It’s fantastic to see Pragmatic Play Slots go live with Fortuna in their own backyard, where our games have already proved popular with players. Our product offering is now available to the operator across a number of key European regulated markets.”

Myke Foster, Group Head of Gaming & Commercial Strategy at Fortuna Entertainment Group, added: “Having already taken Pragmatic Play’s games live in Romania and Croatia, we’re obviously pleased to now bring them to our entire gaming customer base across the FEG estate with the addition of Czech Republic & Slovakia. Both us and our customers know the games well, so it’s a delight to expand our relationship across Central Europe with the incredible team at Pragmatic Play.”

The post PRAGMATIC PLAY SLOTS LIVE VIA FEG IN CZECH REPUBLIC AND SLOVAKIA appeared first on European Gaming Industry News.

-

Eastern Europe4 weeks ago

Eastern Europe4 weeks agoEveryMatrix opens new eco-friendly HQ in Bucharest as it announces 1,000th employee

-

Baltics4 weeks ago

Baltics4 weeks agoThunderkick bolsters presence in Lithuania with 7bet deal

-

Africa4 weeks ago

Africa4 weeks agoA Comparative Analysis Of Land-Casinos and Online Casinos in South Africa 2024

-

Latin America4 weeks ago

Latin America4 weeks agoPeru Gaming Show Announces Expansion

-

GAT Expo Colombia4 weeks ago

R. Franco and R. Franco Digital to present latest products at 25th anniversary of GAT Expo Colombia

-

Australia3 weeks ago

Australia3 weeks agoCrown Approved to Retain its Melbourne Licence

-

GAT Expo3 weeks ago

GAT Expo3 weeks agoPragmatic Play Prepares for GAT Cartagena Gaming Week 2024

-

Australia3 weeks ago

Australia3 weeks agoRabbitohs and Bulldogs Pledge Three More Years to Tackle Sports Betting Advertising