Latest News

Playmaker Capital Inc. Announces Completion of Qualifying Transaction

Not for distribution to U.S. news wire services or for dissemination in the United States

TORONTO, May 31, 2021 (GLOBE NEWSWIRE) — Playmaker Capital Inc. (formerly capital pool company Apolo III Acquisition Corp.) (the “Corporation”) (TSXV: PMKR) is pleased to announce that, further to its comprehensive news release dated April 19, 2021, it has completed the acquisition (the “Qualifying Transaction”) of all of the issued and outstanding securities of Playmaker Capital Inc. (“Old Playmaker”) constituting its “Qualifying Transaction” (within the meaning of Policy 2.4 – Capital Pool Companies of the TSX Venture Exchange (the “Exchange”)). Prior to the completion of the Qualifying Transaction, the Corporation effected a consolidation (the “Consolidation”) of its outstanding common shares (the “Common Shares”) on the basis of one post-Consolidation Common Share for every 4.54 pre-Consolidation Common Shares and changed its name from “Apolo III Acquisition Corp.” to “Playmaker Capital Inc.” (the “Name Change”).

The Qualifying Transaction was completed by way of a three-cornered amalgamation pursuant to which, among other things: (a) Old Playmaker amalgamated (the “First Amalgamation”) with 2830125 Ontario Inc. (“Apolo Subco”), an entity incorporated for the purposes of the First Amalgamation, pursuant to the provisions of the Business Corporations Act (Ontario) (“OBCA”); (b) all of the common shares of Old Playmaker (each, an “Old Playmaker Share”) outstanding immediately prior to the First Amalgamation were cancelled and, in consideration therefor, the holders thereof received post-Consolidation Common Shares of the Corporation (each, a “Resulting Issuer Share”) on the basis of one (1) Old Playmaker Share for one (1) Resulting Issuer Share (the “Exchange Ratio”); and (c) the entity resulting from the First Amalgamation subsequently amalgamated (the “Second Amalgamation”) with the Corporation under the OBCA. In connection with the completion of the Qualifying Transaction, the Resulting Issuer Shares will be listed on the Exchange under the ticker symbol “PMKR”. It is anticipated that trading of the Resulting Issuer Shares under the new ticker symbol will commence on or about June 3, 2021.

Immediately following completion of the Qualifying Transaction, Michael Galego, Vincent Gasparro and Ryan Roebuck resigned from their positions as officer and directors of the Corporation, as applicable, and the following individuals were appointed as the officers and directors of the Corporation:

- Jordan Gnat, Chief Executive Officer and Director

- John Albright, Director

- Jake Cassaday, Director

- Wayne Purboo, Director

- Sebastian Siseles, Director

- Mark Trachuk, Director

- Maryann Turcke, Director

- Michael Cooke, Chief Financial Officer

- Federico Grinberg, Executive Vice President

Immediately before the completion of the Qualifying Transaction and upon the satisfaction or waiver of certain escrow release conditions, each of the 48,000,000 subscription receipts (the “Subscription Receipts”) issued by Old Playmaker on March 31, 2021, pursuant to a concurrent brokered and non-brokered private placement (the “Subscription Receipt Financing”) completed by Old Playmaker led by Canaccord Genuity Corp., as lead agent, together with Echelon Wealth Partners Inc., Eight Capital, PI Financial Corp. and Scotia Capital Inc. (collectively, the “Underwriters”), were automatically converted, without payment of additional consideration or any further action by the holders thereof, into one Old Playmaker Share in accordance with their terms. In connection with the Subscription Receipt Financing, the Underwriters received commission comprised of $1,100,600 cash and an aggregate of 1,575,600 broker warrants (the “Broker Warrants”) of the Company, each Broker Warrant entitling the holder thereof to acquire one Resulting Issuer Share at a price of $0.50 per Resulting Issuer Share for a period of 18 months.

At the effective time of the First Amalgamation, among other things, outstanding Old Playmaker Shares (including those Old Playmaker Shares issued upon the automatic conversion of the Subscription Receipts) were exchanged for Resulting Issuer Shares on the basis of the Exchange Ratio.

No fractional Resulting Issuer Shares were issued pursuant to the Consolidation. If, as a result of the Consolidation, a holder of pre-Consolidation Common Shares was otherwise entitled to a fraction of a Resulting Issuer Share, the number of Resulting Issuer Shares issuable to such holder was rounded down to the nearest whole number. Following the Second Amalgamation, there are 176,576,461 Resulting Issuer Shares outstanding, of which 174,684,461 Resulting Issuer Shares, representing approximately 98.9% of the currently issued and outstanding Resulting Issuer Shares, are held by the former Old Playmaker shareholders. An aggregate of 95,378,412 Resulting Issuer Shares will be subject to value escrow or Seed Share Resale Restrictions pursuant to Exchange Policy 5.4 – Escrow, Vendor Consideration and Resale Restrictions.

For further information regarding the Qualifying Transaction and the Corporation, please see the short form prospectus of Apolo III Acquisition Corp. dated May 21, 2021, which is available on SEDAR at www.sedar.com.

The Corporation is also pleased to announce that all matters submitted to shareholders for approval as set out in detail in the Corporation’s management information circular (“Circular”) dated April 26, 2021 were approved at the annual general and special meeting of the shareholders of the Corporation held on May 26, 2021 (the “Meeting”)

At the Meeting the following items were approved by the shareholders of the Corporation:

- re-appointing MNP LLP as auditors of the Corporation;

- electing the incumbent members of the board of directors, being Michael Galego, Vincent Gasparro and Ryan Roebuck to hold office until closing of the Qualifying Transaction;

- electing Jordan Gnat, John Albright, Jake Cassaday, Maryann Turcke, Mark Trachuk, Sebastian Siseles and Wayne Purboo as new directors of the Corporation, conditional upon and effective on the closing of the Qualifying Transaction, to hold office until the close of the next annual general meeting of the shareholders or until their successors are elected or appointed;

- re-approving the Corporation’s existing stock option plan and approving the Corporation’s new stock option plan effective upon closing of the Qualifying Transaction;

- amending the Corporation’s articles of incorporation to reflect the Consolidation; and

- adopting an advance notice by-law of the Corporation;

In addition to the above, disinterested shareholders of the Corporation voted in favour of the following resolutions proposed in the Circular, thereby implementing certain changes needed to transition to the Exchange Policy 2.4 – Capital Pool Companies, effective as at January 1, 2021 (“Exchange Policy 2.4”):

- authorizing the Corporation to make certain amendments to the Corporation’s escrow agreement; and

- removing the consequences associated with the Corporation not completing a Qualifying Transaction within 24 months of its listing date.

Further information regarding the resolutions passed at the Meeting can be found in the Circular, which is available on the Corporation’s profile on SEDAR at www.sedar.com.

The Corporation is also pleased to announce that it has retained Hybrid Financial Ltd. (“Hybrid”) to provide marketing services to the Corporation in order to heighten its market and brand awareness and to broaden the Corporation’s reach within the investment community. With offices and Toronto and Montreal, Hybrid is a sales and distribution company that uses a data-driven approach to actively connect issuers to the investment community across North America.

Hybrid has agreed to comply with all applicable securities laws and the policies of the Exchange in providing its services to the Corporation and has been engaged for an initial period of six months, beginning June 1, 2021 (the “Initial Term”), renewed automatically for successive six month periods thereafter, unless terminated by the Corporation. The Corporation will pay Hybrid a monthly fee of $15,000, plus applicable taxes, during the Initial Term. The appointment of Hybrid is subject to Exchange approval.

For further information, please contact:

Jordan Gnat

Chief Executive Officer

[email protected]

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Cautionary Statement Regarding Forward Looking Information

This news release contains statements which constitute “forward-looking information” within the meaning of applicable securities laws, including statements regarding the plans, intentions, beliefs and current expectations of the Corporation.

Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or statements formed in the future tense or indicating that certain actions, events or results “may”, “could”, “would”, “might” or “will” (or other variations of the forgoing) be taken, occur, be achieved, or come to pass. Forward-looking information includes information regarding the commencement of trading of the Resulting Issuer Shares, the appointment of Hybrid, the business plans and expectations of the Corporation and expectations for other economic, business, and/or competitive factors. Forward-looking information is based on currently available competitive, financial and economic data and operating plans, strategies or beliefs as of the date of this news release, but involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors may be based on information currently available to the Corporation including information obtained from third-party industry analysts and other third-party sources, and are based on management’s current expectations or beliefs. Any and all forward-looking information contained in this news release is expressly qualified by this cautionary statement.

Investors are cautioned that forward-looking information is not based on historical facts but instead reflect management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Forward-looking information reflects management’s current beliefs and is based on information currently available to them and on assumptions they believe to be not unreasonable in light of all of the circumstances. In some instances, material factors or assumptions are discussed in this news release in connection with statements containing forward-looking information. Such material factors and assumptions include, but are not limited to receipt of final listing approval from the Exchange, together with the factors referenced in this news release and the long form prospectus of the Corporation dated May 21, 2021 (the “Prospectus”), including, but not limited to, those set forth in the Prospectus under the caption “Risk Factors”. Although the Corporation has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking information contained herein is made as of the date of this news release and, other than as required by law, the Corporation disclaims any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Corporation has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Corporation does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Latest News

Atlas-IAC’s CEO Maxim Slobodyanyuk Talks Winning Strategies & Vision for Future Growth in the iGaming Sector

Atlas-IAC, a Next-Generation iGaming platform, has been recognized as the Best Sports Betting Provider Of The Year and Rising Star In Sports Betting Technology at the Prague Gaming & Tech Awards 2024. The GamingTECH Awards annually determine industry excellence in Central and Eastern Europe. Maxim Slobodyanyuk, CEO of Atlas-IAC, tells about insights into Atlas-IAC’s innovative solutions that are reshaping the iGaming landscape and the core principles of partnership driving mutual evolution for both Atlas-IAC and its esteemed operators.

Congratulations on winning “Best Sports Betting Provider Of The Year” and “Rising Star In Sports Betting Technology” at the GamingTECH CEE Awards 2024! How does Atlas-IAC feel about receiving such prestigious recognition?

We take pride in being acknowledged as the best sports betting provider and the rising star in sports betting technology across Central and Eastern Europe. At the heart of our success lies a team of exceptional visionaries, developers, and business analytics striving to elevate the industry to new heights of technological innovation and responsible gaming practices.

I’d like to thank our great partners for choosing Atlas-IAC as their technology provider, and for subscribing to our core business principle — to evolve and grow together. Our win is our partners’ win as well.

To be the best sports betting provider entails a weighty responsibility, one we approach with unwavering dedication. These awards serve as a validation of our unwavering commitment to excellence and as a catalyst for renewed determination to shape the future of sports betting technology. We are grateful for recognition and remain resolutely committed to charting new horizons of success alongside our valued partners.

Could you provide insights into the strategies that drove Atlas-IAC’s success in the iGaming industry?

At Atlas-IAC, our success strategy revolves around building strong partnerships and establishing a notable presence in the competitive global entertainment technology market. We prioritize automation, which gives us an edge in emerging markets and allows us to onboard partners quickly and streamline operations.

Continuously improving our platform to offer a seamless Sportsbook API experience is a priority. Our aim is to deliver fast performance, smooth betting experiences, real-time risk management, advanced anti-fraud measures, and scalable solutions for partners worldwide.

Staying up-to-date, enhancing our product, analyzing market and partner needs, and proactively responding to them are essential. Being the top technological partner is a strategy that consistently works for us.

How does Atlas-IAC’s in-house developed Sportsbook differentiate itself from competitors?

Atlas-IAC’s in-house developed Sportsbook sets us apart because we have full control over its features and can make rapid improvements. Features like Personal Odds Boost and Clever Margin allow for customized experiences tailored to our partners’ needs. We focus on personalization, ensuring the product aligns perfectly with each operator’s requirements. With a skilled team dedicated to our partners’ needs, we can promptly address requests and deliver effective solutions.

Atlas-IAC offers one of the most automated Sportsbook available in the market. How does automation enhance the experience for both operators and users?

Our fully automated Sportsbook API is efficient and user-friendly, enhancing engagement and retention. It’s equipped to handle high demand periods effectively and offers tools for precise betting management and reliable results. We can swiftly develop and integrate custom modules for partners, giving us a competitive edge. We prioritize meeting partners’ needs while delivering enjoyable experiences for players, fostering mutual benefit for all involved.

What specific features or tools have been well-received by operators in the iGaming industry?

In the realm of iGaming, Atlas-IAC has garnered recognition for its remarkable adaptability and keen responsiveness to the requirements of our partners. Understanding the distinctive needs of each operator, we have crafted a tailored approach to ensure effective solutions.

One specific example of our successful tools is our Cashback feature, which serves as a versatile tool for promoting sporting events and enhancing player entertainment. This feature offers customizable settings based on specific sports, events, odds criteria, and frequency. With such flexibility, operators can effectively incentivize participation and elevate excitement levels among players.

In essence, the suite of features and tools offered by Atlas-IAC not only addresses the diverse needs of operators but also fuels engagement and growth within the iGaming industry.

What are Atlas-IAC’s goals for continued innovation and growth in the iGaming sector?

Looking ahead, our primary aim is to continually push the boundaries of innovation while delivering outstanding value to our partners. We remain steadfast in our commitment to leading the charge in the iGaming sector, fostering sustainable growth, and championing responsible gaming practices. Our strategy revolves around staying agile, adapting to emerging trends, and catering to the unique needs of operators worldwide.

The evolving sports betting landscape of 2024 underscores the critical importance of adaptability and innovation. Operators must navigate this dynamic environment marked by technological advancements and regulatory shifts, and Atlas-IAC stands ready to assist them in this endeavor.

In terms of market focus, we are meticulously evaluating opportunities in LATAM, Eastern Europe, South-East Asia, and Africa. These regions offer significant growth potential, and our tailored strategy is geared towards effectively meeting the unique demands of these diverse markets.

The post Atlas-IAC’s CEO Maxim Slobodyanyuk Talks Winning Strategies & Vision for Future Growth in the iGaming Sector appeared first on European Gaming Industry News.

Latest News

How to avoid failing at affiliate marketing in 2024?

Reading Time: 4 minutes

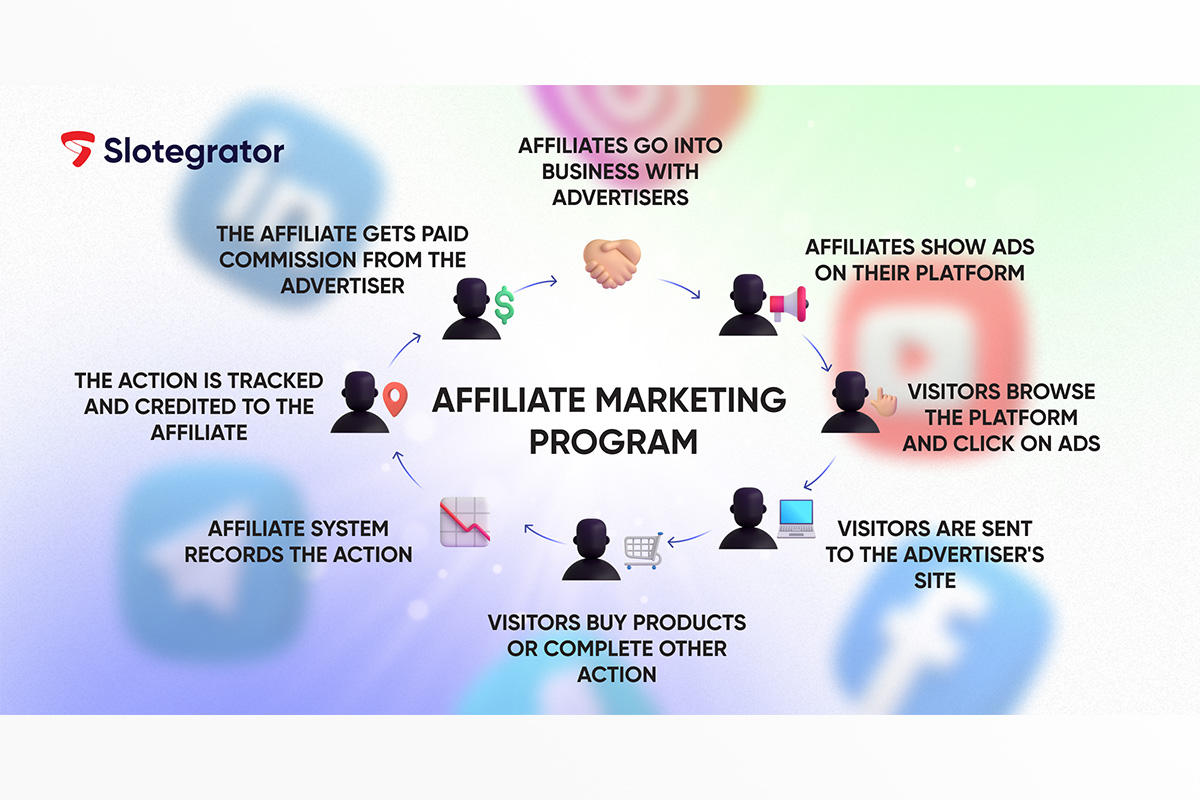

The evolving landscape of affiliate marketing within the iGaming ecosystem presents both opportunities and challenges due to regulatory shifts. Adapting to these changes is crucial to navigate the dynamic environment effectively. Slotegrator experts exploring strategies to avoid pitfalls globally and adopting adaptable approaches can optimize affiliate marketing amidst evolving regulations.

The iGaming industry has had to focus on a number of changes in the area of affiliate marketing – as a result of regulatory and advertising changes.

Beyond that, it’s important to keep in mind another important key initiatives that include key components of a successful affiliate program:

- The quality of the content the affiliate creates.

- Regulations the affiliate or affiliate program might be subject to.

- This is especially important if the affiliate expects a commission for every sign-up. If the affiliate is getting paid for every player they send your way, the players need to stay for a while for it to be worth it.

- An ongoing analysis of the size and quality of traffic the affiliate is delivering you.

To know more about these points you can read an instruction from the Slotegrator Academy by link.

The changes have not only affected the regulatory environment of the iGaming industry, but also affiliate marketing as a result of the general changes. What is important to look out for?

Slotegrator shares some regional specifics of affiliate marketing:

- Asia is a diverse and dynamic region for affiliate marketing in the iGaming industry. Affiliates operating in Asia have to navigate complex regulatory conditions and varying cultural attitudes. Marketing managers have to employ strategies that prioritize mobile channelization, collaboration with opinion leaders, and compliance with local laws — all of which are essential to success.

- Affiliate marketing in Africa is still in its early stages but is already showing significant potential. With the increasing availability of the internet and the spread of smartphones, the continent is opening up opportunities for affiliates to reach a fast-growing market. However, factors such as regulatory uncertainty, payment processing difficulties, and the cultural diversity of the region need to be taken into account.

- In Latin America working with local affiliates who have a deep understanding of the regional market helps to better customize marketing campaigns and achieve higher conversion rates. Given the strict regulation of gambling in some Latin American countries, it is important to comply with local laws and advertising restrictions to avoid negative consequences.

- Affiliate marketing in Europe is a dynamic and competitive landscape where effective strategies and a professional approach can ensure significant business success and growth in the iGaming sector. One of the important parts of affiliate marketing in Europe is the use of a variety of channels to build audiences. It helps to diversify and increase the flow of traffic to the partner’s site, which helps to increase conversion rates. Careful research of each country’s rules and restrictions is needed regarding the advertising and promotion of gambling.

Alyce Fabel from CasinoRIX, Slotegrator’s media partner, summarizes key aspects for affiliate companies to concentrate on.“As each year passes, affiliates must strive to improve and keep pace with the market. Competition is growing, regulations are evolving, and that brings changes to many regions. We can highlight five key points for affiliate companies to focus on:

- Continuously search for and acquire new traffic channels. It’s crucial not to focus only on one channel; diversification is necessary. This has been particularly evident in the past year, with significant changes and updates in SEO and mobile traffic (iOS/Android applications).

- Ensure content quality. As AI tools continue to advance, it’s essential not only to learn to apply them in work but also to differentiate content written by humans from AI-generated content (especially crucial for SEO projects).

- Configure deep analytics. Constantly work on improving traffic quality and understand where to make enhancements. The standards for traffic quality are rising.

- Provide added value. It’s time to start developing the product aspect as well, thinking not only as an affiliate but also about providing customers with additional value. This will also help in achieving higher-quality marketing.”

Cultivate relationships with partners. Build strong and lasting relationships, stay informed about all industry changes and news, and keep up with technologies and innovations. This is crucial for achieving high results.

And some words about the affiliate marketing trends as a compass to guide development efforts in this area in the right direction. Khoren Ispiryan, sales manager at Slotegrator, and the speaker of the latest Prague Gaming & TECH Summit ‘24, shares some insights:

- “The best thing is to include real people in the affiliate marketing. To create an environment where bloggers, streamers and influencers will make a bigger impact on the end user behavior.

- In 2024, gambling companies will continue to partner with influencers and other internet celebrities. These partnerships will be increasingly effective methods of attracting new audiences, promoting products, and increasing brand awareness.

- Loyalty programs and other ways of enhancing the user experience will also be essential for the promotion of gambling websites.

- The development of partner relationship management software will be a major priority. It will help improve usability for affiliate partners and enable better communication between companies and affiliates. For instance, Partnergrator from Slotegrator offers a solution for online gambling platform operators who face difficulties in tracking their affiliate program data. This innovative solution provides the ability to manage and analyze affiliate programs in real-time, using analytics to simplify the decision-making process.”

The post How to avoid failing at affiliate marketing in 2024? appeared first on European Gaming Industry News.

Latest News

GiG Media Secures 3rd Place in EGR Power Affiliate Ranking for Consecutive Year

GiG Media, a subsidiary of Gaming Innovation Group (GiG), today proudly announces it has secured 3rd position in the prestigious EGR Power Affiliate Ranking for the second year running.

This achievement underscores the business’ unwavering dedication to strategic innovation, expanding its market reach and delivering unparalleled value to its partners and shareholders.

GiG Media’s portfolio of high-quality traffic websites, including WSN.com, Time2play.com, Askgamblers.com and Casinotopsonline.com, has been instrumental in driving its success. With operations spanning across Malta, Denmark, Serbia, and Spain, GiG Media continues to set the benchmark for lead generation in online sportsbooks and casinos.

Commenting on the achievement, Jonas Warrer, CEO of GiG Media, stated:

“We are delighted to receive this acknowledgement yet again in the EGR Power Affiliate Ranking and this is nothing short of a testament to the hard work and dedication of our team. This superb accomplishment reflects our relentless pursuit of excellence, internal talent, and continuous growth in the iGaming affiliate landscape. As we continue to grow the business in 2024, we remain steadfast in our commitment to players, partners and the industry alike.”

GiG Media’s portfolio expansion and strategic diversification have been pivotal in propelling its growth trajectory. Its ongoing product development and recent acquisition of Time2Play Media emphasise the company’s proactive approach to seizing emerging opportunities and reinforcing its market leadership position.

The post GiG Media Secures 3rd Place in EGR Power Affiliate Ranking for Consecutive Year appeared first on European Gaming Industry News.

-

Africa4 weeks ago

Africa4 weeks agoA Comparative Analysis Of Land-Casinos and Online Casinos in South Africa 2024

-

Latin America4 weeks ago

Latin America4 weeks agoPeru Gaming Show Announces Expansion

-

GAT Expo Colombia4 weeks ago

R. Franco and R. Franco Digital to present latest products at 25th anniversary of GAT Expo Colombia

-

Australia3 weeks ago

Australia3 weeks agoCrown Approved to Retain its Melbourne Licence

-

GAT Expo3 weeks ago

GAT Expo3 weeks agoPragmatic Play Prepares for GAT Cartagena Gaming Week 2024

-

Africa1 week ago

BMM Testlabs Continues Its Expansion in Africa with New Licenses in Botswana and Nigeria to Test Land-Based and Digital Products

-

Australia4 weeks ago

Australia4 weeks agoRabbitohs and Bulldogs Pledge Three More Years to Tackle Sports Betting Advertising

-

Compliance Updates2 weeks ago

Compliance Updates2 weeks ago3 Oaks Gaming extends European reach with Romania licence